Inclusive Lending

Women's History in Homebuying and The New Trailblazers

March 1, 2024

It's Women's History Month, and women have taken the lead in homeownership. Before they were trailblazers, though, there was a time when women weren't allowed to become homeowners. Read on to learn about women's history in homeownership, the leaders making change, and the resources helping women achieve their homeownership dreams.

Women Faced Obstacles in the Past

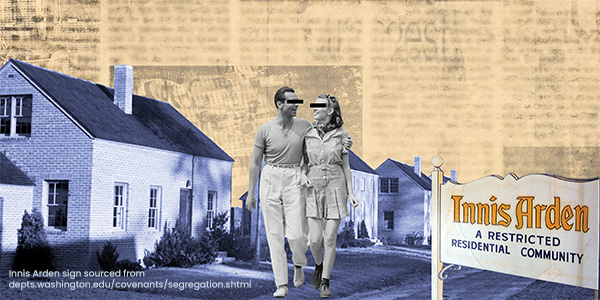

Historically, women have faced many obstacles in their pursuit of homeownership. During the early 20th century, women owning property was considered unconventional and even scandalous. Cultural norms dictated that women take on domestic responsibilities, while their financial capabilities were disregarded and underestimated.

Legally, women were subject to various restrictions, such as the inability to enter into contracts or own property without the consent of their husbands. These barriers made it virtually impossible for women to secure mortgages and become homeowners in their own right.

The tide began to turn in the mid-20th century when the women's rights movement gained momentum. Pioneering women fought tirelessly for legal reforms and equal opportunities, challenging the status quo and demanding recognition of women's financial independence.

Because of their efforts, landmark legislation was enacted; the Equal Credit Opportunity Act of 1974 and the Fair Housing Act of 1968. These two pieces of legislation prohibited discrimination based on gender in lending and housing practices. And that's when things began to change, slowly.

The Triumphant Story of the Rise of Women's Homeownership

Today, we celebrate the triumph of women becoming the largest sector of homeowners compared to single men. According to The Pew Research Center, single women-owned 58% of the nearly 35.2 million homes owned by unmarried Americans, while single men held 42%. Women of color have played a significant role in driving this growth, with Black women making up a substantial part of female homeowners.

Why Homeownership Matters for Women

When women become homeowners, it directly challenges and shifts societal norms and expectations regarding gender roles and financial independence. Homeownership for women symbolizes a significant stride towards equality, granting them the security and stability of owning their place and the autonomy to make substantial financial decisions independently. It represents breaking barriers in a traditionally male-dominated arena, reinforcing women's capabilities and rights to build and control their wealth. This move towards homeownership is a highlight of the importance of inclusivity and diversity in building a more equal society.

Leaders in Women's Homeownership

Countless women across the country are making significant strides in transforming the housing market; Patty Arvielo is a prime example. She is the Co-Founder and CEO of New American Funding (NAF) and a partner in #WeAllGrow Latina, a vibrant community dedicated to elevating and supporting Latina creators, entrepreneurs, and innovators. This collaboration not only amplifies the voices of Latina women but also fosters an environment where their economic and social empowerment is paramount. #WeAllGrow, with its mission to enhance visibility and community for Latinas, mirrors Arvielo's commitment to nurturing female leaders and celebrating their resilience and success.

Arvielo's unwavering dedication to expanding opportunities for women has had a profound impact on homebuyers and the culture at NAF. The publication Newsweek recognized NAF as one of America's Greatest Workplaces for Women in 2024. Another testament to Arvielo's success in creating an exceptional workplace culture, implementing policies that support women, and advancing gender equality. This recognition highlights her significant contributions to making the housing market more inclusive and accessible to all.

Resources for Prospective Women Homeowners

For women aspiring to embark on the journey toward homeownership, several programs and initiatives are available to help them become homeowners. While the availability of these programs can vary by location and over time, here are a few options:

- HUD's Homebuying Programs: The U.S. Department of Housing and Urban Development (HUD) offers various programs to help first-time homebuyers and low-income individuals, including women, purchase a home.

- Freddie Mac CreditSmart® Homebuyer U: This comprehensive educational program guides first-time homebuyers through the homebuying process, focusing on building credit, budgeting, and understanding mortgage products.

- Local Women's Housing and Economic Empowerment Programs: Many local nonprofit organizations offer programs to help women become homeowners. These programs often include financial education, counseling, and assistance with the homebuying process.

- NeighborWorks America: This national network of community development organizations provides a range of services to prospective homebuyers, including homebuyer education courses, one-on-one housing counseling, and financial assistance programs, many of which have a focus on supporting women.

Start Your Homebuying Journey Today

In celebrating Women's History Month, we honor the strides women have made in homeownership, with single women emerging as the leading demographic of homeowners. This journey, from overcoming historical obstacles to embracing financial independence, underscores the importance of industry leaders who have paved the way for such achievements. To begin your journey toward homeownership, reach out to NAF today.

Smart Moves Start Here.

Smart Moves Start Here.