Inclusive Lending

Mosi Gatling Breaks Barriers for Fair Housing Month

March 29, 2024

As we step into April, which is Fair Housing Month, it's a time to reflect on the progress and ongoing efforts to make homeownership a reality for Black and diverse individuals. Amid conversations on equity and fairness in housing, Mosi Gatling, SVP of Strategic Growth and Expansion at New American Funding, emerges as a leader in a more inclusive future in homeownership. Read on to discover the impact of Fair Housing, tips on navigating the homeownership journey, and learn about Mosi Gatling's transformative work.

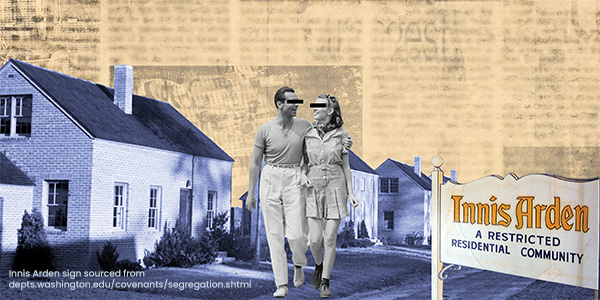

The Fair Housing Act

Fair Housing Month celebrates the pivotal Fair Housing Act of April 1968, which aimed to eradicate discrimination in housing. While it laid the groundwork for equality, the journey towards true fair housing for everyone, including diverse communities, is ongoing. This month reminds us of the foundation we must build on and the work ahead to make sure housing practices become more inclusive and fairer for all.

Mosi Gatling: Your Advocate for Diverse Homeownership

With her role as the SVP of Strategic Growth and Expansion at NAF, Mosi Gatling and her extensive experience as a Loan Originator uses her deep understanding of the housing market to champion diverse homeownership. She's crafting homeowner-friendly programs and strategies to make understanding and accessing the housing market easier. Gatling believes in "creating and harvesting a more authentic experience for homeowners," making sure that they're spoken to in a relatable language, "Talk to people like they would want to talk to their friend if their friend had so much experience in the same mortgage business." She believes in avoiding overwhelming industry jargon and focusing on guidance that resonates with homebuyers' unique experiences and aspirations.

Overcoming Barriers

Gatling's mission extends beyond mere transactions. She's deeply committed to fostering a genuine connection where the homebuyer feels recognized, heard, and empowered to overcome obstacles to homeownership. Understanding that a loan denial can often feel like discrimination, Gatling emphasizes the importance of simplicity, transparency, and empathy in the housing industry. She aims to transform it into a nurturing space where you can confidently seek advice and support.

Gatling shares, "Being denied opportunity can feel like or be perceived as discrimination as well. So, I'll deconstruct everything, ask them a ton of questions, and then we sit and figure out their path to ownership." This approach is about breaking down barriers and dispelling myths, making sure that discussions about homeownership are empowering and enlightening.

Gatling's philosophy revolves around listening to concerns, actively working to address them, and providing a roadmap to homeownership and beyond. "I want us to keep it simple," Gatling insists. Her dedication lies in making the housing market accessible and understandable.

Taking Immediate Action and Empowerment

Gatling is addressing the stagnation in Black homeownership rates head-on. With only a slight increase in Black homeownership since 1968, she says it's "time to turn it up a bit" with new programs and initiatives designed to break down the barriers Black and diverse people face in achieving homeownership. This goal is driving her work at NAF.

Leveraging Down Payment Assistance for Wealth Building and Beyond

Gatling helps make homeownership possible by focusing on down payment assistance programs. She highlights these programs as beneficial and essential tools for prospective homeowners. Gatling passionately believes that these programs are a strategic asset for a broader audience. They are not limited to those who cannot afford a down payment and she aims to redefine their perception and use. "Everyone in free enterprise loves to leverage other people's money," she explains, positioning down payment assistance not merely as aid but as an opportunity for financial leverage.

Gatling talks about the significance of these assistance programs in helping buy a home, and the significance of them laying a foundation for future financial security and wealth-building. She advocates for a shift in perspective, seeing homeownership as a pivotal step in a comprehensive strategy for long-term wealth accumulation. This approach underscores the importance of maintaining financial flexibility and preparedness for unpredictable occurrences. "If I can in any way help someone have that nest egg even after they close on a home, so they don't deplete all their funds, I think that's critical," Gatling shares, highlighting her holistic view of financial planning in the context of homeownership. Her strategy is more than helping people purchase a home. She also helps homeowners use financial tools to create future stability and resilience. And using the down payment assistance programs is one way to create that future wealth.

Tips Tailored for the Prospective Homeowner

- Educate Yourself: Embrace the resources and programs available to support you in homeownership.

- Seek Trusted Partners: Choose professionals who genuinely want to help you through your journey to homeownership.

- Leverage Financial Aids: Explore programs that offer financial assistance, which can help you maintain stability as you achieve homeownership.

- Plan for Sustainability: Remember, homeownership is about long-term sustainability. Prepare yourself for the journey ahead.

NAF, Your Path Forward

As Fair Housing Month unfolds, Gatling is tirelessly working to make homeownership dreams a reality for Black and diverse homebuyers. Through education, empowerment, and systemic change, the vision for a more inclusive and equitable housing market is within reach. Start your journey towards homeownership by contacting NAF today.

Smart Moves Start Here.

Smart Moves Start Here.