Inclusive Lending

Juneteenth: Honoring the Legacy of Freedom for All

June 19, 2024

Juneteenth, celebrated on June 19, marks a pivotal moment in American history. On this day in 1865, news of the Emancipation Proclamation finally reached Texas, two years after it was signed.

The arrival of Union soldiers under the command of General Gordon Granger in Galveston brought the long-awaited announcement of freedom to the last remaining enslaved African Americans. This signaled the actual end of slavery in the United States.

On that day, Granger read what is known as "General Orders No. 3." It stated: "The people of Texas are informed that, in accordance with a proclamation from the Executive of the United States, all slaves are free."

The following year, on June 19, formerly enslaved people in Texas began celebrating their freedom. The tradition has since grown and spread nationwide.

Texas declared Juneteenth a state holiday in 1979. Other states followed suit. In 2021, Congress made Juneteenth a national holiday, which President Joe Biden signed into law on June 17.

Juneteenth is the first new federal holiday since Martin Luther King Jr. Day in 1983. However, the day has long been celebrated in the Black community.

"Emancipation Day, Richmond, Va." Photograph. Detroit Publishing Co., c1905. Library of Congress, Prints and Photographs Division, LC-DIG-det-4a12513. https://www.loc.gov/pictures/item/2016804723/.

Supporting the Black community has been a priority for New American Funding since the mortgage lender’s inception in 2003.

New American Funding, co-founded by first-generation Hispanic American Patty Arvielo, has become a leader in lending to underrepresented communities. This includes the Black community. Patty's experience overcoming socioeconomic barriers and discrimination inspired her to create initiatives to support these groups.

One of those initiatives is NAF Black Impact, established in 2016. The initiative’s mission is grounded in providing unparalleled customer support, solidarity with Black employees and consumers, and offering ongoing cultural awareness training.

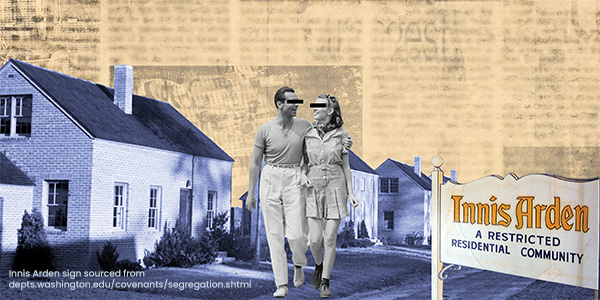

NAF acknowledges the historical challenges and systemic barriers Black individuals face and uses intentional language in marketing to help Black clients achieve homeownership. NAF Black Impact takes direct, action-oriented steps to address credit accessibility and promote sustainable and equitable homeownership for Black individuals and communities.

"Juneteenth is a day to celebrate liberation and reflect on our nation's past. And while we’ve made great progress, there’s still plenty of work to be done to end discrimination, especially in housing,” said Mychael Fields, sales manager at New American Funding. “By mirroring the communities that we serve and educating people on the products and programs available to them, we're helping to create a world where everyone has a place to call home.”

By striving to shape a diverse and inclusive landscape for homeownership, NAF is trying to ensure Black communities have the support and resources they need to achieve their homeownership dreams. This is an effort to close the racial wealth gap.

These actions are only part of the equation. NAF has also committed to lending $20 billion to Black borrowers over the next five years. This commitment is a cornerstone of the company’s efforts to help deserving individuals nationwide build wealth and own their homes.

NAF offers additional programs designed to help clients overcome financial barriers that may stand in the way of homeownership. They include:

- Pathway to Homeownership – Everyone deserves the chance to build wealth by owning their own home. With the Pathway to Homeownership program, first-time homebuyers in select areas may be eligible for up to $8,000* in down payment and closing cost assistance.

- 5-Year Rate Protection Pledge– With our 5-Year Rate Protection Pledge, borrowers can refinance with no repeat lender fees or appraisal fees** if rates drop in the next five years after they lock in their rate.

- NAF Cash – NAF Cash, an affiliated company of New American Funding***, can turn clients into cash buyers to help them to secure their dream homes, maybe even for under the asking price. Buying in cash may help customers save up to 11% over those using a traditional mortgage****.

New American Funding believes in the transformative power of Black homeownership and is dedicated to supporting the dreams of individuals and families nationwide.

As the nation celebrates Juneteenth, NAF honors the resilience and achievements of the Black community. NAF remains committed to creating opportunities, fostering equity, and building a future where everyone can thrive.

*Due to maximum seller concession rules, discount can be less than $8000 in some cases where other concessions have been made to the consumer. This is not a loan commitment or guarantee of any kind. All mortgage loan products are subject to credit and property approval.

**If rates change, you may qualify for a refinance loan with New American Funding. New American Funding will cover the cost of an appraisal up to $500. Applicants are responsible for any amount in excess of $500. To qualify the client will be required to provide a complete application, submit requested documentation, and have their credit pulled. Refinance offer is available after six (6) payments have been made on the original purchase loan. Terms and conditions are subject to change without notice. Due to maximum seller concession rules, discount can be less than $500 in some cases where other concessions have been made to the consumer. Contact your loan officer for more information. By refinancing your existing loan, your total finance charges may be higher over the life of the loan.

***NAF Cash is fulfilled by NAF Cash LLC, an affiliated real estate company of New American Funding that is managed and operated in compliance with applicable legal and regulatory requirements. NAF Cash LLC does not originate loans or issue loan commitments. Terms and Conditions apply. Not available in all states. MI Real Estate Broker #6502431375. 41050 W 11 Mile Rd, Suite 220, Novi, MI, 48375. Phone 844-344-0531.

****According to a study from researchers at the University of California - San Diego, cash buyers have paid about 11% less than using a mortgage. Reher, Michael and Valkanov, Rossen, The Mortgage-Cash Premium Puzzle (September 24, 2021). Available at SSRN: ssrn.com/abstract=3751917 or dx.doi.org/10.2139/ssrn.3751917

Smart Moves Start Here.

Smart Moves Start Here.