Inclusive Lending

Innovative Solutions to Homeownership Disparities

May 20, 2024

In the United States, homeownership is a cornerstone of economic prosperity, yet significant disparities persist among groups that have historically been underrepresented in homeownership, including Black, Hispanic, and Asian communities. These disparities highlight systemic inequalities that have excluded minority groups from the benefits of homeownership. New American Funding (NAF), under the leadership of its Latina Co-Founder & CEO, Patty Arvielo, is at the forefront of addressing these challenges with targeted, innovative strategies.

Historical Context of Homeownership Disparities

The roots of homeownership disparities lie deep within America's history of racial segregation and economic discrimination. Practices such as redlining, which began in the 1930s, systematically denied diverse populations access to mortgage loans and insurance based on the racial makeup of their neighborhoods. Though the Fair Housing Act of 1968 made such discrimination illegal, the long-term effects continue to impact diverse communities. Properties in historically redlined areas are often devalued, leading to lower property values, reduced wealth accumulation, and limited economic mobility for residents. These systemic barriers have perpetuated a cycle of economic disadvantage and underinvestment in diverse communities, making the dream of homeownership elusive for many.

New American Funding's Strategic Approaches

Cultural Competency in Lending:

NAF is committed to diversity and inclusivity in its hiring practices. By employing loan officers who mirror the ethnic and cultural backgrounds of the communities they serve, NAF fosters a deeper understanding and connection with its clientele. This approach builds trust and ensures that the financial services provided are relevant and sensitive to the unique needs of diverse homebuyers.

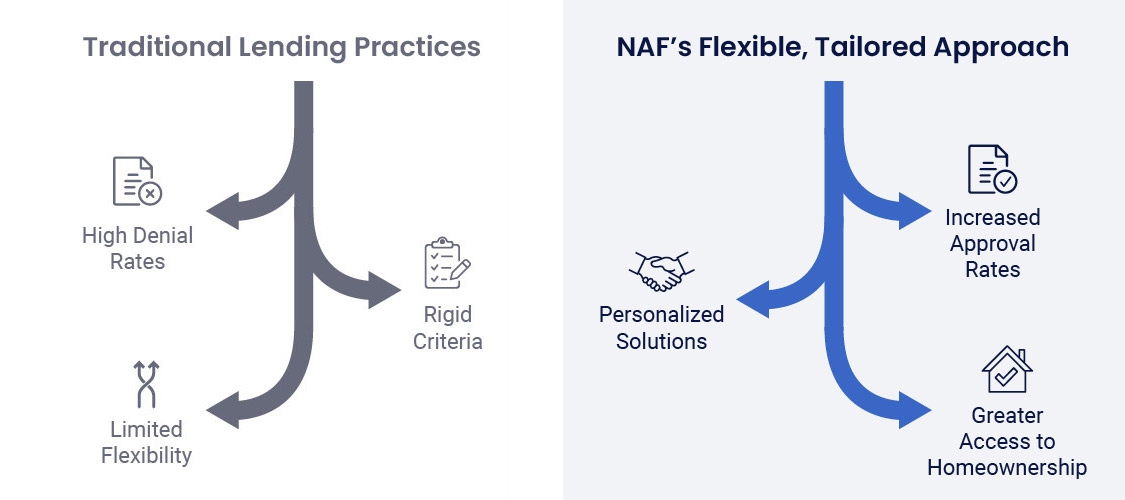

Customized Lending Practices:

Recognizing the unique financial landscapes of diverse communities, NAF adapts its lending practices to effectively meet these needs. This includes developing lending solutions sensitive to cultural differences and barriers typically faced by these communities. Instead of a one-size-fits-all approach, NAF customizes its financial services to accommodate factors like varying credit histories, non-traditional income sources, and other economic conditions prevalent in these populations. This strategic adaptation goes beyond mere compliance, striving to enhance access to homeownership.

Financial Innovations and Assistance:

To tackle the financial barriers faced by prospective diverse homebuyers, NAF has developed tailored financial solutions. These include down payment assistance programs and flexible lending options that accommodate the varied financial situations of diverse households. Moreover, NAF's partnership with UQUAL enables clients to improve their creditworthiness and mortgage eligibility, which are crucial steps in preparing for successful homeownership.

Tailored Loan Programs by NAF

NAF has pioneered specialized loan programs to reduce barriers to homeownership for the underrepresented. These programs include flexible underwriting criteria that consider non-traditional income and employment verification processes that accommodate diverse employment situations common in diverse communities. For example, the ability to use remittances as proof of income helps bridge the gap for families with members working abroad. Such initiatives reflect NAF's deep understanding of the economic profiles in these communities, making homeownership more accessible and aligning financial services with the real-world conditions of prospective diverse homebuyers.

Challenges and Barriers in the Current Landscape

Despite progressive initiatives like those of NAF, diverse homebuyers continue to encounter significant obstacles. High mortgage denial rates for Black and Hispanic applicants underscore persistent disparities in lending practices. Economic factors such as lower average incomes and credit scores further complicate access to homeownership for these groups. Moreover, the enduring effects of discriminatory policies continue to impact property values and investment in minority neighborhoods, perpetuating cycles of poverty and exclusion from mainstream economic opportunities.

Future Directions and Solutions

NAF continues to work to close the homeownership gap by implementing lending practices tailored to underrepresented communities' unique financial realities. With a focus on hiring culturally competent loan officers and customizing loan options to better serve diverse homebuyers, NAF is enhancing access to homeownership. NAF's ongoing initiatives inherently support broader economic and social benefits. These initiatives, as outlined in NAF's White Paper, Empowering Homeownership: Bridging the Gap for Diverse Communities”, aim to address disparities in homeownership by enhancing access to financial services, empowering diverse communities through education, and fostering trust through culturally sensitive lending practices. NAF is well-positioned to leverage these developments to benefit diverse communities, aiming to elevate homeownership rates and foster greater economic inclusion.

Addressing the homeownership disparities in the U.S. is essential for economic equity and social stability. Through its targeted programs and advocacy, NAF is making significant strides toward closing this gap, proving that with dedication and innovative solutions, progress is not only possible but achievable. Reach out to NAF to begin your homebuying journey.

Smart Moves Start Here.

Smart Moves Start Here.