Inclusive Lending

Hispanic Homeownership on the Rise - Infographic

January 10, 2024

A Steady Climb in Homeownership Rates

The landscape of American homeownership is witnessing a remarkable trend: the steady rise of Hispanic homeowners.

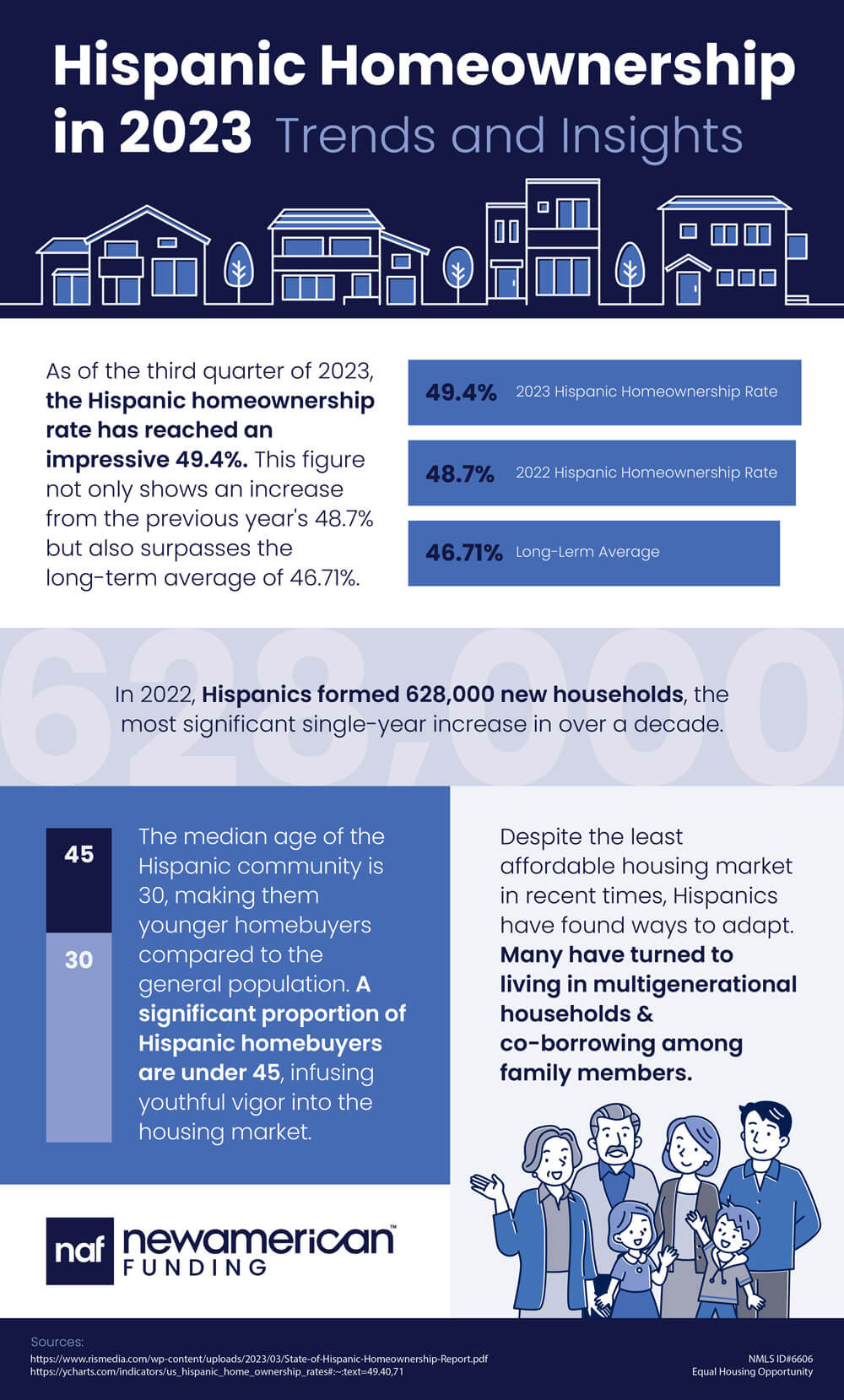

As of the third quarter of 2023, the Hispanic homeownership rate has reached an impressive 49.4%. This figure not only shows an increase from the previous year's 48.7% but also surpasses the long-term average of 46.71%. The growth shows the toughness and determination of the Hispanic community in the face of evolving economic conditions.

The Resilience Amid Market Challenges

2022 began with an intensely competitive real estate market, spurred by record-low interest rates. However, as the year progressed, a sharp rise in mortgage rates, coupled with soaring home prices, presented significant affordability challenges. Despite these obstacles, Hispanics emerged as the only demographic to record eight straight years of steady homeownership gains, reaching a rate of 48.6% in 2022.

Key Drivers of Hispanic Homeownership Growth

Several factors have contributed to this healthy growth in Hispanic homeownership:

- Robust Household Formation: In 2022, Hispanics formed 628,000 new households, the largest single-year increase in over a decade.

- Youthful Dynamism: The median age of the Hispanic community is 30, making them younger homebuyers compared to the general population. A significant proportion of Hispanic homebuyers are under 45, bringing more youthful buyers into the housing market.

- Overcoming Affordability Hurdles: Despite the least affordable housing market in recent memory, Hispanics are finding ways to adapt. Many have turned to living in multigenerational households and co-borrowing with family members.

- Texas: A Land of Opportunity: Texas stands out as a hub for Latino homeownership. The state has seen substantial Latino net migration, meaning more Latinos are moving to Texas than are moving away, and has consistently created opportunities for new Latino homeowners.

The Road Ahead: Opportunities and Innovations

The Hispanic community's journey toward homeownership is set to continue on its positive path. Innovative solutions like Special Purpose Credit Programs (SPCPs) are emerging to address common underwriting challenges, potentially narrowing the homeownership gap between Latinos and non-Hispanic Whites.

Smart Moves Start Here.

Smart Moves Start Here.