Inclusive Lending

Hispanic Homeowners Are Building Wealth: This Is How Much It’s Paying Off

September 23, 2024

With Hispanic Heritage Month in full swing, there's plenty to celebrate—especially when it comes to Hispanic homeownership.

Homeownership has been a driving force behind the surge in Hispanic wealth in the U.S., according to the 2024 State of Hispanic Wealth Report. (The report was prepared by the National Association of Hispanic Real Estate Professionals and the Hispanic Wealth Project.)

Hispanic homeowners now have 26.4 times the net worth of Hispanic renters, according to the report. That’s a median net worth of $233,100 compared to just $8,840 for renters. This significant difference shows how important homeownership is for building wealth that can be passed down through the generations.

The U.S. Latino gross domestic product (GDP) reached $3.6 trillion in 2022. That’s comparable to the fifth-largest economy in the world, just behind Germany, according to the 2024 Official LDC U.S Latino GDP Report.

“The success of the Hispanic community is tied to the overall economic well-being of our country,” said Caroline Isern, SVP of Multi-Cultural Lending at New American Funding.

How the Hispanic community is achieving homeownership

Many Hispanic families are reaching financial milestones by using methods such as increasing their income, living in multi-generational households, and exploring loans tailored to their financial situations.

Nearly half, about 48.5%, of all Hispanic households were homeowners in the second quarter of 2024, according to recent data from the U.S. Census Bureau.

Fannie Mae has supported this growth by introducing resources like HomeView en Español, a Spanish-language digital education platform offering information on financial literacy and homeownership and expanding down payment assistance programs to better serve Latino communities.

“Greater financial opportunities have driven this growth,” said Nikki Rosas, NAHREP Government Affairs Co-Director for the San Antonio Chapter. “As our community becomes more aware of programs like down payment assistance and specialized lending options, such as ITIN or Non-QM loans, homeownership is becoming more accessible for seasoned entrepreneurs and others with unique credit needs.”

ITIN loans allow individuals without Social Security numbers to qualify for mortgages, while Non-QM loans offer flexible options for self-employed borrowers or those with non-traditional credit histories. These lending options may be helpful for entrepreneurs and those who don’t fit into the conventional loan criteria.

Since 2013, an additional 2.8 million Hispanic families have joined the ranks of homeowners, marking a growth rate of 41%, according to the 2024 State of Hispanic Wealth report. That far outpaced the overall population's homeownership growth of just 14%,

The median household income for Hispanic families rose to $65,540 in 2023, according to the U.S. Census Bureau.

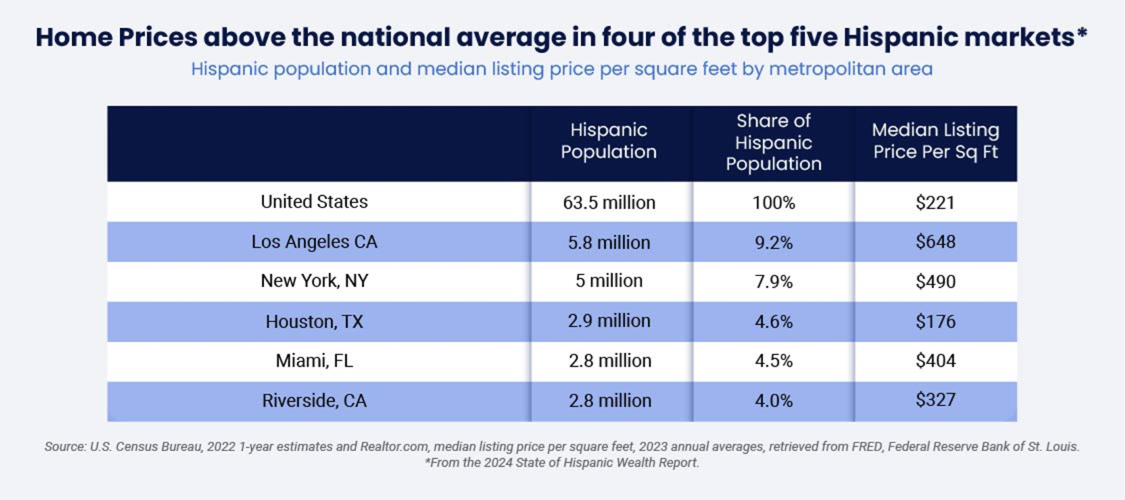

The Hispanic community is buying homes in high-cost areas

A common myth is that most Hispanic homebuyers are purchasing properties in low-cost areas.

But 71% of Hispanic home purchases in 2023 were in middle- and upper-income neighborhoods. Four of the top five Hispanic homebuying markets—Los Angeles, New York, Dallas, and Riverside, Calif.—had median home prices that were higher than the national average, according to the report.

For example, the median home list price nationally was $429,990 in August, according to Realtor.com data. Yet the typical home was listed for $1.19 million in the Los Angeles metro area; $750,000 in the New York metro; $444,990 in the Dallas metro; and $599,000 in the Riverside metro, according to Realtor.com data.

Many Hispanic families will pool their resources to purchase a home, said Greg Nino, a Houston-based real estate agent for RE/MAX Compass. They may live together in multi-generational households to save money.

Nearly a third, 31.4% of Hispanic Americans lived in multigenerational households in 2022, compared to the rest of the country, according to the Census Bureau.

Nino also noted families often use FHA loans and down payment gifts to make homeownership more attainable. FHA loans are government-backed mortgages that allow buyers to qualify with lower down payments and more flexible credit requirements, making it easier for many families to purchase homes.

“The goal is to set their kids up for success by providing them with a home," said Nino.

Smart Moves Start Here.

Smart Moves Start Here.