Inclusive Lending

Barriers to Homeownership: Why Black Homeownership Rates Remain Low

February 3, 2025

Less than half of Black Americans are homeowners. That’s a sobering statistic considering homeownership is one of the main ways that generations of Americans have built wealth and moved into the middle-class.

However, the Black community faces many barriers to homeownership that date back centuries and continue to this day. These include having less financial help from family and friends to being more likely not to be approved for a mortgage.

Black Americans have consistently had the lowest homeownership rate of any race. Just 45.7% of households were homeowners in the fourth quarter of 2024, according to a U.S. Census Bureau report.

That was compared to 74.2% for white households, 62.5% for Asian households, and 48.8% for Hispanic households in the same quarter.

“Black Americans have been known to be rejected, whether that’s for a job or credit,” said Shanta Patton-Golar, a marketing manager at New American Funding and a Las Vegas-based real estate agent. “We may not immediately want to go to a mortgage preapproval because we think we are more than likely going to be rejected.”

High home prices and mortgage rates hurt homebuyers

High home prices and elevated mortgage rates have made it challenging for many first-time buyers to get into the housing market.

The lack of homes for sale has also hurt Black buyers, especially as the shortage of lower-priced homes on the market has led to higher prices.

“The scarcity of homes raises the overall price of housing,” said Courtney Johnson-Rose, president of the National Association of Real Estate Brokers (NAREB), an industry group for Black real estate professionals.

These cost burdens have been particularly hard on Black buyers. Of all the races, Black households had the lowest median incomes of $56,490 in 2023, according to the Census Bureau.

Meanwhile, Asian households earned a median $112,800, white households brought in $89,050, and Hispanic households took home $65,540 in 2023.

This puts Black buyers at a financial disadvantage, leading many to take out loans to help pay for higher education, vehicles, and other needs.

“Black workers are less likely to have college degrees,” said Michael Neal, a senior fellow at the Housing Finance Policy Center at the Urban Institute, a think tank. “The jobs you can get with a college degree do tend to be higher paying.”

Black Americans may also be more cautious about the economy in the aftermath of the financial crisis in the late 2000s. Black homeowners were disproportionately affected during the Great Recession, with many losing their homes to foreclosure.

“There is a degree of uncertainty of what the economy will look like in the future,” said Neal. “You may not be willing to make the type of long-term investment that homeownership requires if you’re uncertain about whether you will have a job and if the economy will be okay.”

Black homebuyers face higher mortgage denial rates

Black homebuyers are more than twice as likely to be denied a mortgage than white buyers. Roughly 17% were not approved for a loan compared to 7% of white buyers, according to the 2024 State of Housing in Black America report from NAREB.

The main reason Black applicants were rejected were higher debt-to-income ratios. That means they have amounts of debt relative to the amount they earn.

“When you have less wealth, you have to take out student loans, you have to take out car loans,” said Andre Perry, a senior fellow at the Brookings Institution. “When you have less of a financial cushion, you are forced to take on debt to get ahead.”

Credit history was another big reason that Black borrowers weren’t approved for mortgages, according to the report.

“Black consumers are more likely to have lower credit scores,” said Neal. “They might not have put together enough financial activity for them to [even] have a credit score.”

Even Black homebuyers who are approved for mortgages face obstacles. They are twice as likely to receive a higher-cost loan than white buyers, according to the NAREB report.

This may at least partially be because buyers may be afraid to get quotes from multiple lenders, fearing it will ding their credit scores. They may not realize that these soft pulls have a minimal effect on their scores.

Black buyers may also not know about down payment assistance programs or realize they may be eligible for this funding. These programs can help eligible buyers come up with down payments and help to cover closing costs.

“There is a fear of the financial system,” said Perry. “There’s a real fear that they will be taken advantage of, they’ll be lowballed at appraisal time, they’ll get a much higher interest rate.”

Black homebuyers may have less generational wealth

Members of underrepresented communities also may not receive as much financial support from friends and family as other buyers. That may make it more difficult for diverse homebuyers to come up with down payments and cover closing costs on a home.

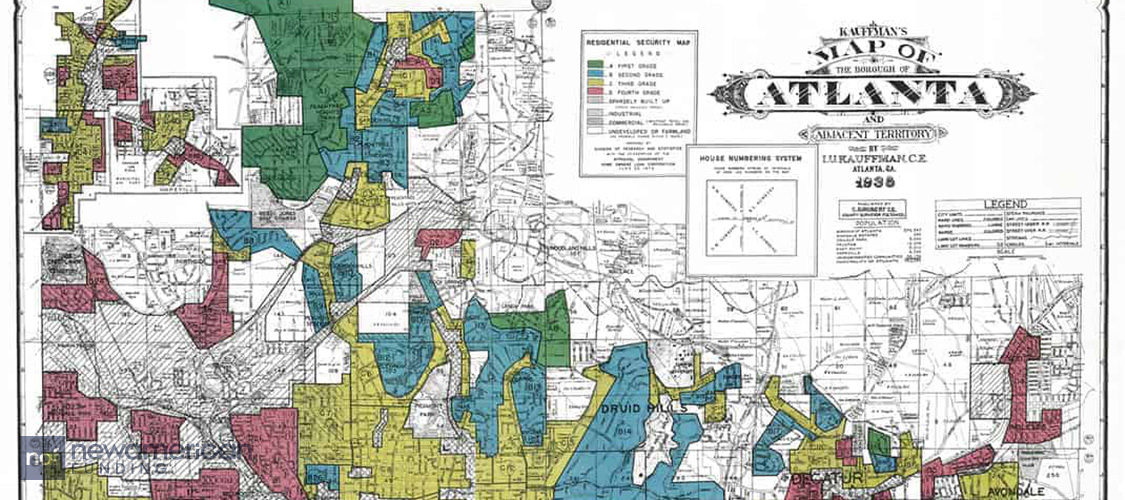

Redlining, deed restrictions, and eminent domain prevented many Black families from purchasing and keeping homes after World War II. That made it harder for many families to build wealth.

Also, homes in communities of color may not be as desirable to buyers as those in other areas. The residences may be smaller, constructed with less expensive materials, and the neighborhoods may lack the amenities of other communities. This can push home values down, resulting in families not having as much to leave for future generations.

“Practices of the past made it less likely that Black families would have the kind of wealth that they could pass on to their children,” said Perry.

NAREB’s Rose pointed out there are more than two million mortgage-ready Black Americans with the incomes and credit scores to become homeowners.

“There’s a lack of confidence in our community,” said Rose. “[Many] don’t know what it takes to purchase a home.”

Smart Moves Start Here.

Smart Moves Start Here.