Housing News, Videos

Unprecedented

March 12, 2020

Welcome back to the Mortgage Rundown. Today we are going to talk about what’s happening in the capital markets and interest rates around the world.

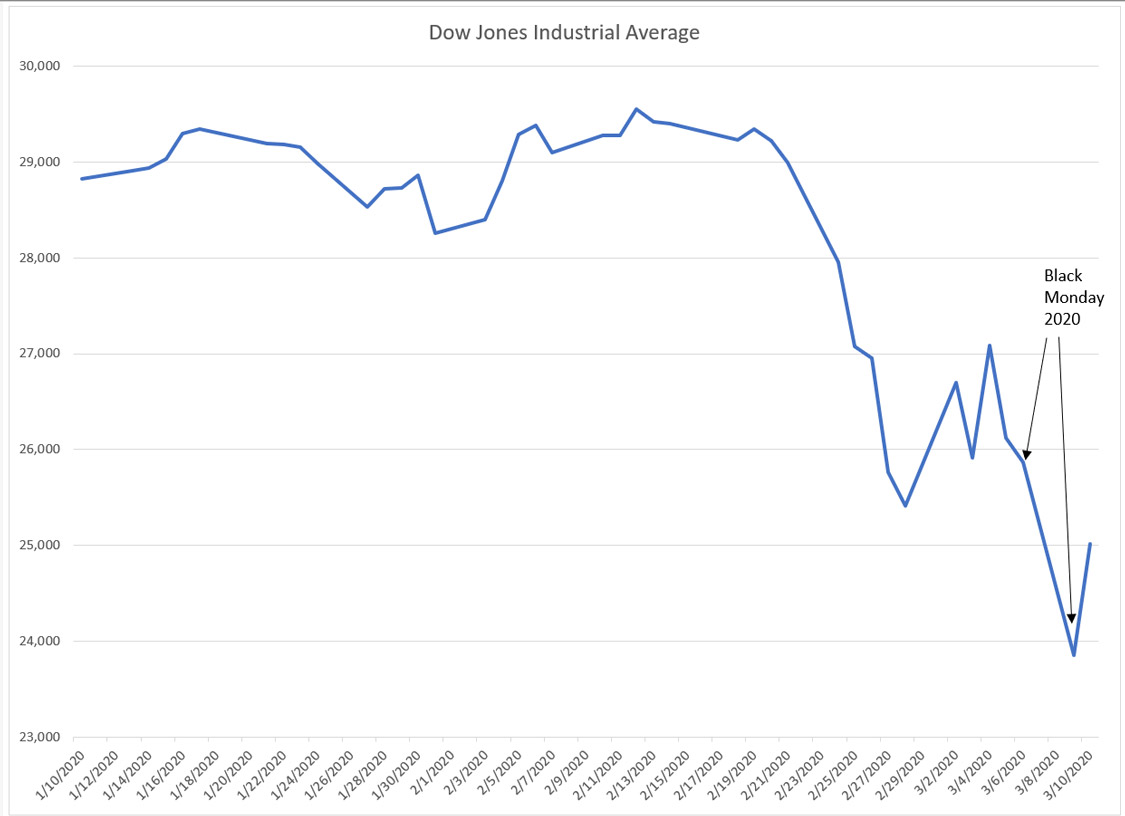

No doubt by now you’ve seen the volatility in both the stock and bond markets. Treasury and mortgage rates saw all-time lows and stock price volatility hit all-time highs.

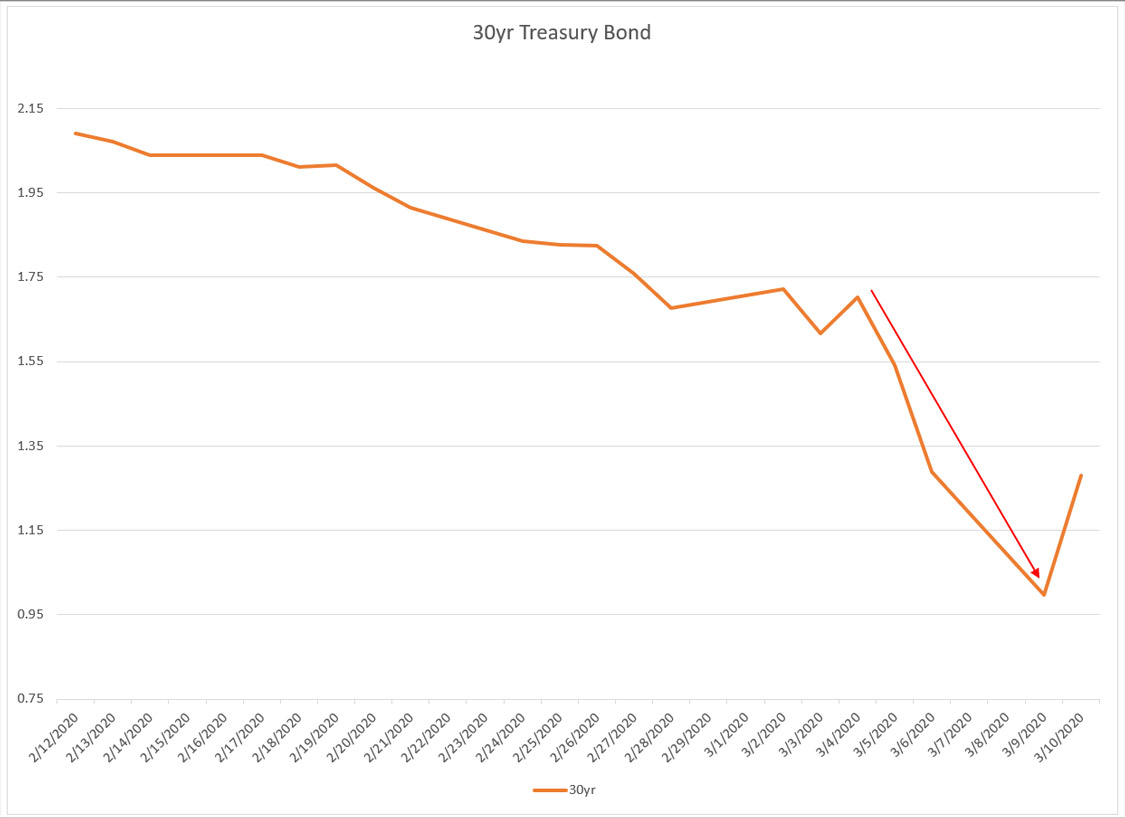

Take for example the 30-year Treasury bond, which for all practical purposes is the best gauge of the long-term outlook for the US economy. Longer-term outlooks generally don’t change as frequently or with as much volatility as shorter-term outlooks. However, in the past week, the 30-year Treasury bond has experienced the greatest amount of volatility in its entire history, going all the back to when it was first issued in 1970.

Volatility in Treasury bonds centered around the threat of a recession related to the coronavirus has created more single-day interest volatility than the Great Recession, the terrorist attacks on September 11th, Black Monday of 1987, and other major events in history.

March 9th of this week is now known as Black Monday 2020, with the stock market halting after 4 minutes of trading, the Dow Jones Average dropping over 2,000 points on the day, the 10yr falling below 0.5% and gold rising over $1,700 an ounce.

This has created havoc all over the market and the fallout from all of these recent events has been a rapid drop in mortgage rates. This rapid drop, unfortunately, creates a lot of issues with mortgage-backed securities trading all over the map. Irrational pricing occurs which ultimately can get very confusing for loan officers and borrowers. These types of dislocations occur for a few months before realigning to a different market as expectations sync up with reality.

Expect continued volatility over the next several weeks as information and the impact of the coronavirus work their way through the news and the trading levels of bonds and stocks. After the market calms down, hopefully, the dislocations in the mortgage-backed securities market will normalize and as lenders clear out their pipelines, mortgage rates will align closer with Treasury rates.

Smart Moves Start Here.

Smart Moves Start Here.