Housing News

This Is How Much Home You Can You Afford on Your Salary

November 18, 2024

Many homebuyers have browsed listings and swooned over the photos of a particular property, only to later realize it may not be within their price range.

That's why buyers may want to reach out to a loan officer and figure out just how much home they can afford before they begin their search.

Lenders will look closely at the salaries of prospective buyers to help determine whether someone may qualify for a mortgage—and if so, how large of a loan.

For example, the typical household made $80,610 in 2023, according to the U.S. Census Bureau. (Households include individuals; couples; multi-generational families who live under the same roof; or even roommates, in some situations.)

Those buyers might be able to afford a home up to $297,175 at a 7% mortgage. (This assumes they made a 9% down payment and did not have any credit card, auto, student loan or other debt that could make it difficult to qualify for a larger loan. The calculation also factors in a debt-to-income ratio of 36%. It also includes a 1.25% propert tax rate, a 0.50% home insurance rate, and 0.75% for mortgage insurance and other fees. The exact percentages may vary greatly depending on the location where someone purchases a home.)

“It’s tough,” said New American Funding Chief Investment Officer Jason Obradovich. “This generation of buyers is facing more difficulties with home affordability than prior generations.”

Those hoping to buy a $1 million home would have to make $271,253 a year.

What do mortgage lenders consider when looking at how much home someone can afford?

How much the buyers earn each year is a good indicator of the price point that they will be able to go when purchasing a home. But it’s not the only thing that determines how much home someone may qualify to purchase.

Mortgage rates also play a large part. The higher the rate, the more expensive the monthly mortgage payments will be, as it increases the cost of borrowing.

Additionally, buyers may not be able to afford as much home as they could if rates were lower. Many real estate experts anticipate mortgage rates will come down, at least a little, in 2025.

“When mortgage rates are back to the 5% range, which they are anticipated to return in the next year or two, that will increase the buying power of borrowers,” said Obradovich.

The size of the down payment also matters. The more someone puts down, the more home they may be able to afford.

If they make a down payment of at least 20%, they may be able to avoid paying private mortgage insurance. This can also free up additional funds to put toward a larger mortgage payment.

The amount of debt that a buyer has is also important. If they have a large car payment, owe a lot on their credit cards, and are paying off their student loans, they may not have as much left over to put toward their monthly mortgage payments.

These are all part of the equation that lenders consider when determining whether they are going to lend to a person or not—and the amount of the loan itself.

How buyers may be able to make homeownership more affordable

There are ways that homebuyers may be able to make purchasing a home more affordable.

If they choose a U.S. Department of Veterans Affairs (VA) or U.S. Department of Agriculture (USDA) loan, they may not need to have a down payment when buying a home.

Those who choose a Federal Housing Administration (FHA) loan may only need to put down as little as 3.5%. Conventional loans also offer down payments of as low as 3%.

There are also down payment assistance programs that may help provide buyers with the funding they need to make a down payment and even contribute to closing costs. This funding may be available as a grant or a low-interest loan.

In addition, those who purchase a home at today's higher rates may be able to buy down the mortgage rate temporarily or for the duration of the loan.

And when rates do fall, as anticipated, homeowners may be able to refinance their mortgages into new ones with lower rates. This could save them money each month on their housing payments.

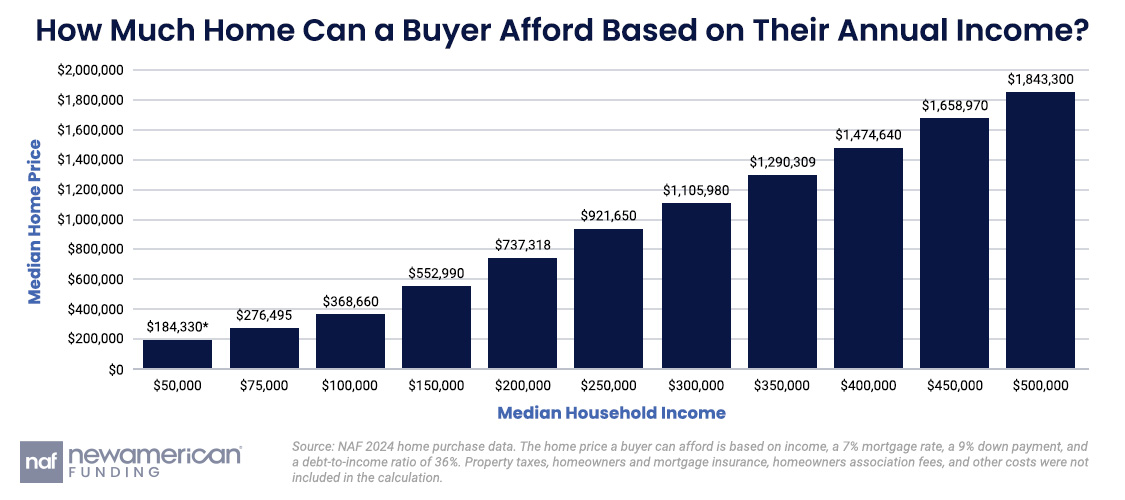

How much home can a buyer afford based on their annual income?

Median household income: $50,000

Median home price: $184,330*

Median household income: $75,000

Median home price: $276,495

Median household income: $100,000

Median home price: $368,660

Median household income: $150,000

Median home price: $552,990

Median household income: $200,000

Median home price: $737,318

Median household income: $250,000

Median home price: $921,650

Median household income: $300,000

Median home price: $1,105,980

Median household income: $350,000

Median home price: $1,290,309

Median household income: $400,000

Median home price: $1,474,640

Median household income: $450,000

Median home price: $1,658,970

Median household income: $500,000

Median home price: $1,843,300

Source: NAF 2024 home purchase data

Smart Moves Start Here.

Smart Moves Start Here.