Housing News, Videos

Supply and Demand: Interest Rates Go Down

February 28, 2019

Today we are going to talk about what’s happening with interest rates.

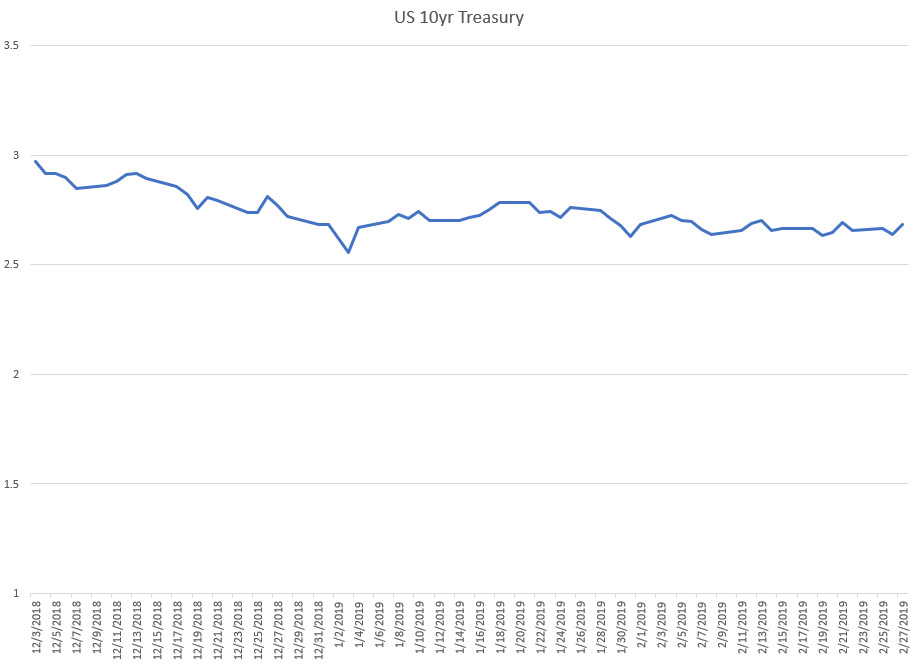

While Treasury rates have been very stable with the 10-year trading between 2.63% and 2.73% for the past month or so, there is an interesting dynamic going on with mortgage rates that’s worth talking about.

Back before the financial meltdown, there was limited involvement in the mortgage rate market by the federal government. But post-meltdown the United States government has been buying Treasury securities and mortgage-backed securities.

As of last week, the Federal Reserve owns approximately $2.2 trillion in Treasuries and $1.6 trillion in mortgage-back securities. What that has done is brought down interest rates for consumers and homebuyers via supply and demand.

The challenge for banks, credit unions, investment funds, and other typical buyers is that the US government is competing with them for assets. More buyers mean lower yields for everyone.

Now what we have been and will likely continue to see is that due to the low yield on those assets, especially with the 10-year at only a 2.68% yield, is the investment community is looking for yield in other areas. With the stock market near its highs and this general feeling that the economy is not growing at the rate it once was, where do investors find yield?

A lot of the typical buyers of Treasuries and MBS are looking at the non-agency securities market. Without going through all of the details of that market, it does not have the size nor scale to meet investor demand and that’s pushed a lot of yield buyers to the whole loan market.

The whole loan market is where loans are bought and sold in their whole form. They are not broken into different tranches and classes of securities. That demand has led to some interesting nuances where borrowers on jumbo loans are finding lower rates than someone getting a conforming loan. Banks, credit unions, and others are gobbling up these lower-risk jumbo loans. That’s crossing over to the expanded credit market as well.

It’s become somewhat of a buying frenzy as mortgage origination volume has been lower than normal these past few quarters.

In the coming weeks, you should keep an eye on the following items:

- With volatility at very low levels it’s important to watch out for headline risk.

- Also, today is GDP for the 4th quarter and our most important inflation measurement, PCE, comes out tomorrow

Smart Moves Start Here.

Smart Moves Start Here.