Housing News

Spring 2024 Housing Trends: Prices, Equity, and Impact

April 17, 2024

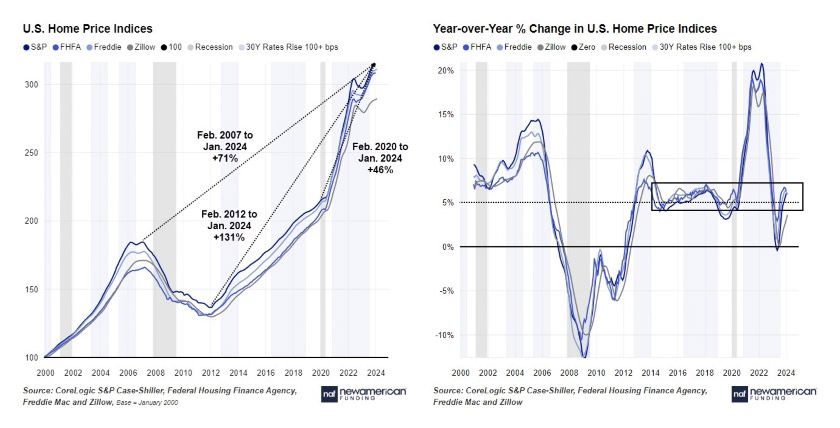

As we enter the bustling spring housing market, potential homebuyers face a common hurdle: sticker shock. Home prices have risen, returning to annual growth rates exceeding 5%, reminiscent of the pre-pandemic era. This isn't just a number—it means significant gains in homeowners' equity have been pushed past the $30 trillion milestone. With the share of underwater mortgages falling to 0.2% and the rising use of home equity, there has been speculation about the potential economic effects, including worries about inflation reacceleration.

A Closer Look at the Numbers

January 2024 brought some eye-opening statistics when it comes to home prices: CoreLogic S&P Case-Shiller reported a 6.07% annual growth rate. The Federal Housing Finance Agency noted a 6.35% increase, and Freddie Mac's models showed a 6.19% rise. This growth isn't just a spike; it represents a substantial leap from historical benchmarks.

Home prices are surging, outpacing both inflation and household incomes. For context, the most recent S&P Home Price Index reading shows that home prices are now 71% higher than the housing bubble peak, 131% higher than the years following the peak, and 46% higher than pre-pandemic levels in nominal terms.

Today's Equity Surge

This period of growth has been kind to homeowners, with equity levels hitting an all-time high of $31.79 trillion, as of December 2023. This figure marks the highest share of total real estate market value since December 1960 and equates to an average of $368,715 per owned household. However, this wealth is distributed unevenly across all demographics. The majority sits with households in the top 80–99% of the distribution, who claim 43%. Baby Boomers control half; college-educated households have 68%, and white households have 80%.

The Mortgage Landscape

The surge in home prices has significantly mitigated the risk of borrowers being underwater on their mortgages, with only 0.2% of active loans exceeding a 100% loan-to-value ratio. This is in sharp contrast to the height of the financial crisis and speaks volumes about the current strength of the housing market.

Home Equity Lending: A Reluctant Tap

Despite these robust equity levels, homeowners have yet to tap into this wealth. Despite $512.34 billion in outstanding home equity lending debt, many homeowners are hesitant to tap into this resource, perhaps due to the lingering memory of the financial crisis. Yet, with over half of HELOC commitments unused, there's a potential for significant economic impact if these funds were circulated. If these reserves transition from paper to active, reining in inflation could become even more daunting for the Fed, potentially leading to the reacceleration many are concerned about.

Regional Variations in the Housing Market

Across the United States, the housing market's performance varies significantly by region. Cities like Miami, Los Angeles, San Diego, and Tampa have seen substantial growth, outpacing others such as Atlanta, Chicago, and Detroit due to climate, economic health, and housing supply dynamics. However, the markets that have experienced the most rapid growth may also face the most significant correction risks. Nonetheless, the U.S. as a whole, particularly in the Midwest and Northeast, is experiencing the continued rise in home prices, driven by demand and limited new construction.

The Landscape for New Homebuyers

Entering the housing market now requires a strategic approach. The present climate presents distinctive obstacles, especially for first-time buyers who are met with soaring prices and fierce competition. Homebuyer education and preparation are key, as understanding the ins and outs of mortgage rates, down payment programs, and market trends can significantly impact buying power and long-term financial health. Despite the challenges, potential buyers should seek resources and advice to help them become successful homeowners during the buying process.

Long-term Investment Perspectives

Current market conditions underscore the importance of viewing real estate as a long-term investment for existing and prospective homeowners alike. While the market's ebbs and flows can affect short-term decision-making, the overall trend toward growth and equity highlights the steady value of homeownership. By focusing on the future and long-term financial goals, Americans can create a strategy prioritizing sustainable investment over short-term gains that can last a lifetime.

What This Means for You

Whether you're looking to buy, sell, or understand your position in the current market, it's clear that the housing market is more than just a place to call home—it's a critical part of our economic fabric. With the spring market in full swing, staying informed and seeking professional advice can help you navigate the opportunities and challenges that lie ahead.

Smart Moves Start Here.

Smart Moves Start Here.