Housing News, Videos

Promising Signs for Interest Rates Ahead?

April 25, 2019

Today we are going to talk about what's happening with interest rates.

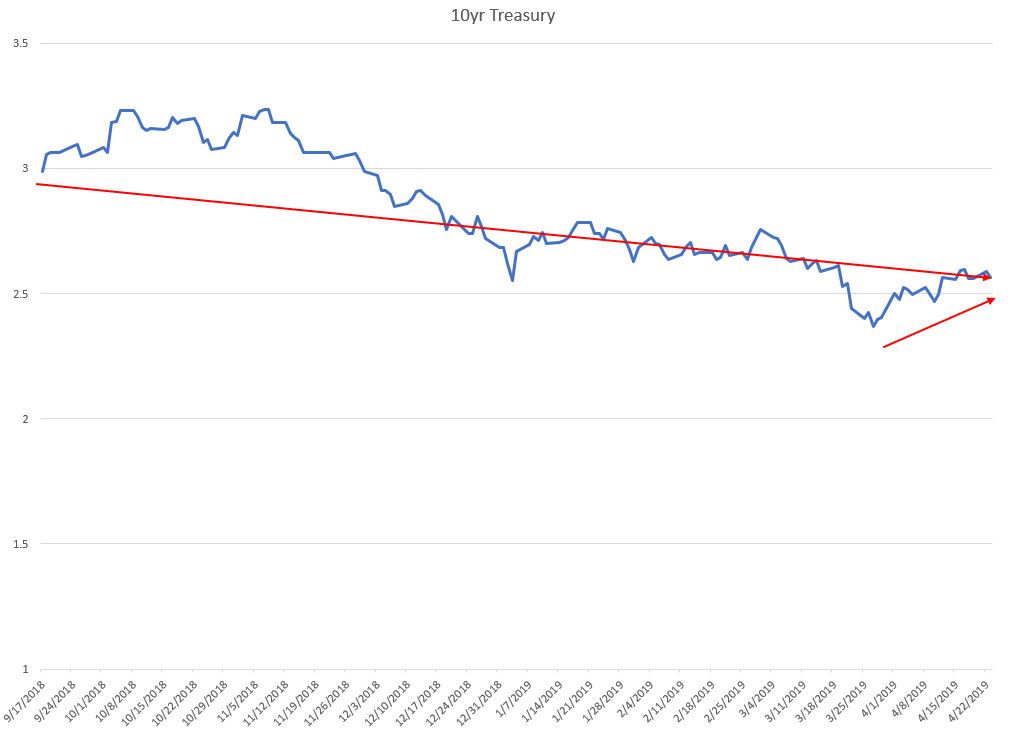

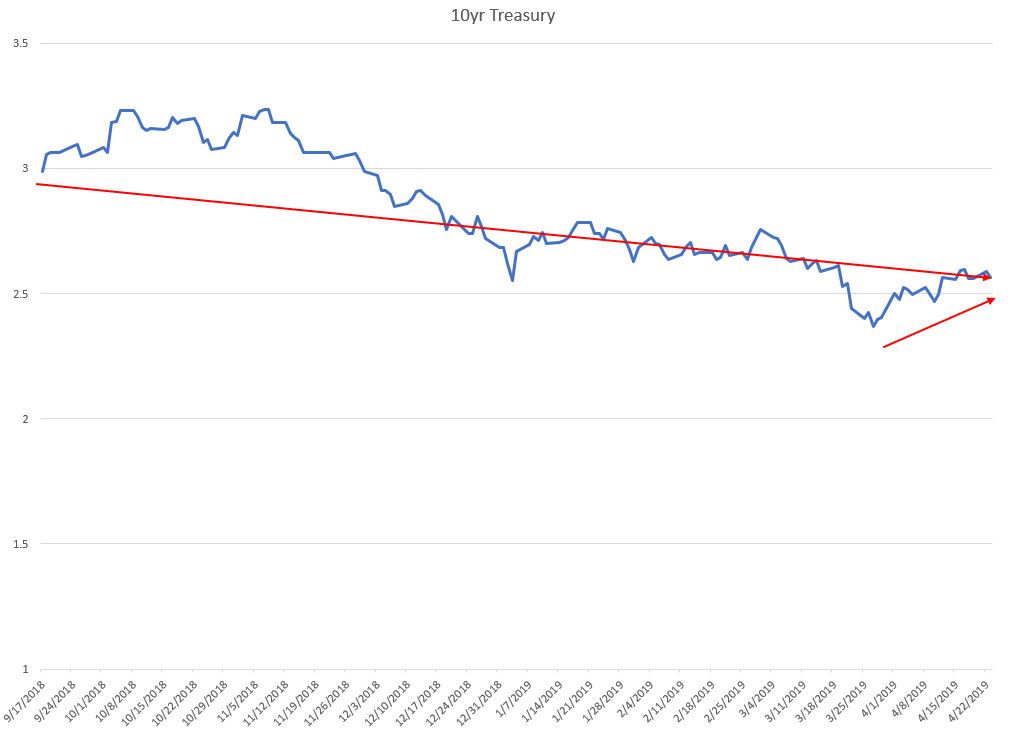

Since our last update, we’ve seen the 10-year Treasury rise up from its 2019 low of 2.37% up to about 2.55% today. It doesn’t necessarily mean that rates are on a serious uptrend. In fact, over the past several months the 10-year has come down materially, but it is finding a new trading range as it bounces off of that 2.37% low.

In terms of economic data this month we’ve seen strong jobs data, subdued inflation, and a stock market that is up 25% since December.

One of the things to watch is the price of oil. Even though it fluctuates based upon supply and demand, inflation, growth, trade wars, military conflicts, OPEC, etc., it is somewhat concerning that the price is continuing to climb very steadily over the past few months. There are some trade tensions and economic sanctions that could continue to escalate that might create inflation concerns which could push rates up higher. Or it could create some growth concerns that drive stock prices and yields down with it.

If we are going to talk about rates, we should talk about the Federal Reserve. The odds of a hike in 2019 are still near zero and the odds they lower rates are at 55%. This is based upon future contracts and I will admit I do believe unless there is a major change to the state of the US economy, the odds that the Fed raises rates should at least be balanced with the odds that they cut rates.

In the coming weeks, you should keep an eye on the following items:

- May 1st is the next FOMC meeting. I wouldn’t expect any fireworks but it will be interesting to hear their language around the state of the economy and their outlook for the rest of 2019.

- I've mentioned it before but continue to watch the price of oil and any headlines around trade. Those are good drivers of fear and expectations around growth and with it, interest rates.