Housing News, Videos

Market Update: November 15, 2018

November 15, 2018

Today we are going to talk about what's happening with interest rates.

Over the past month, we've seen rates hold relatively stable despite the uncertainty around the midterm elections. The 10yr is trading within the range of 3.05 and 3.25% and it’s currently at 3.15%.

However, in the past year, rates are up about 80bps and it’s generally believed the Fed will raise once more in 2018 and twice in 2019. A lot of that will depend on growth and inflation.

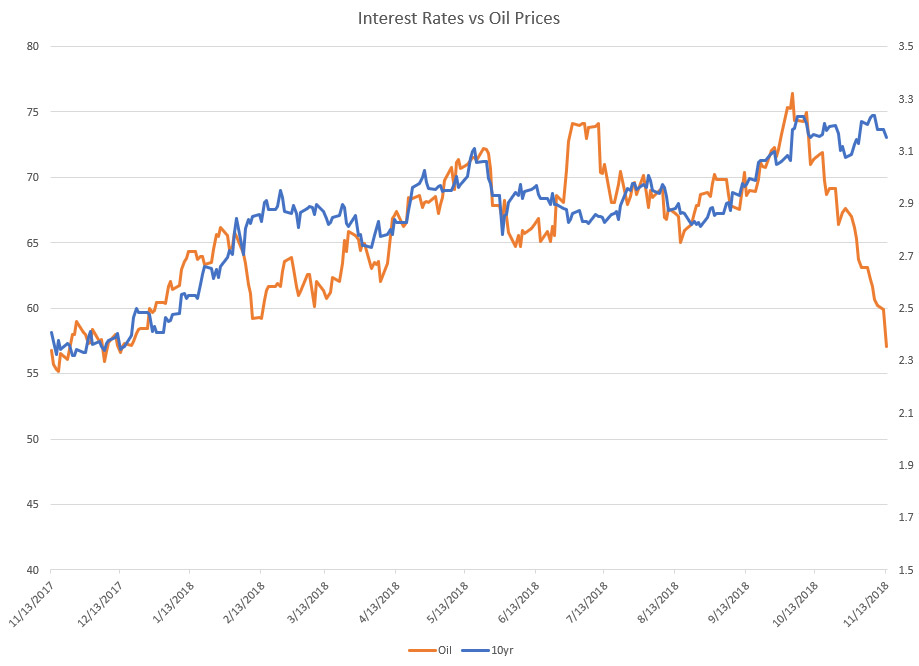

Speaking of inflation, the graph on your screen shows how closely interest rates have tracked oil prices over the past year.

You will notice in the orange line how much the price of oil has dropped recently and has now decoupled with rates. Supply and demand have come to dominate the oil market and inflation is no longer the driver.

What you may not have noticed is lower prices at the gas pump. Even though the wholesale price of gasoline is down 50 cents this past month, stations often are very slow to pass through lower prices to their customers.

Going back to inflation, we saw Core PCE is still stubbornly low, just below 2%. It’s not likely entering the 4th quarter that we will see inflation accelerate as this is typically the slower part of the year. Not to mention that no one party controls legislation after the midterm elections and we can all expect gridlock in Washington, D.C.

In the coming weeks you should keep an eye on the following items:

- We talked about it before and I’ll say it again. Watch the oil market. Will it continue its bearish trend or will it rebound? Will oil prices create some deflationary fears and bring interest rates lower?

- Also, stock prices. The very recent large selloff in equities and oil should cause some concern that growth going into 2019 could be very challenged. With inflation contained and legislation tied up, we can expect earnings will be the main driver of prices as we finish out 2018.

Smart Moves Start Here.

Smart Moves Start Here.