Housing News, Videos

Market Update: March 28, 2018

March 28, 2018

Hello everyone and welcome back to the Mortgage Rundown.

Today we are going to talk about what’s happening in the capital markets.

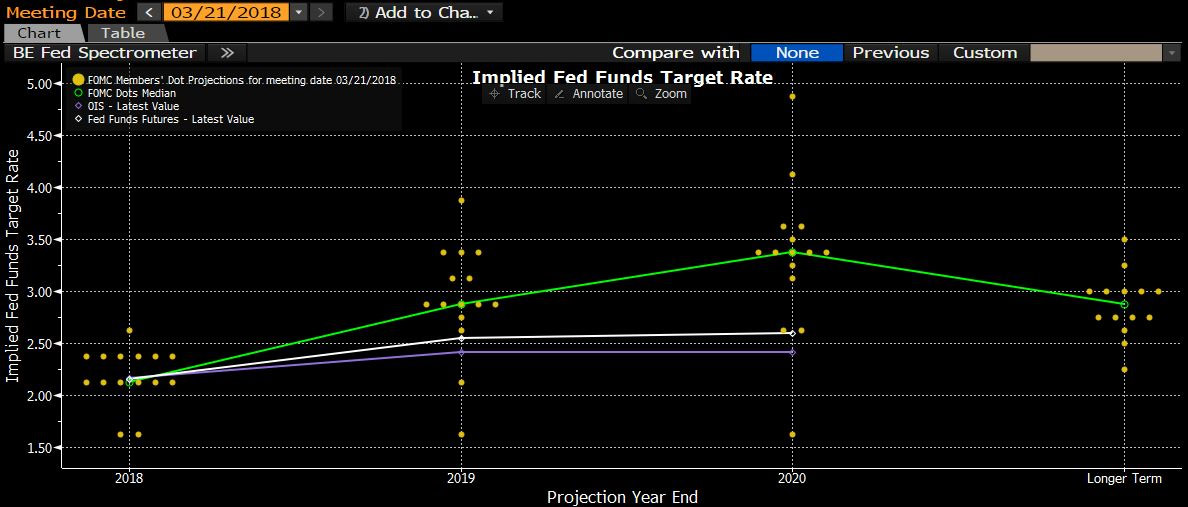

No doubt by now you are aware that the Federal Reserve met last week and raised the benchmark rate 25bps. By and large, this was in line with expectations. However, the committee did update their forecast for future rate increases via the dot plot. Based upon the dot plot the Fed is predicting a total of three interest rate increases in 2018, three increases in 2019, and two increases in 2020.

A quick refresher on the dot plot. Each member of the FOMC estimates what the Fed Funds rate will be at the end of each calendar year. The graph on your screen shows the current dot plot with a green line denoting the median forecast. If you look closely you will notice that two FOMC members see no future increases to the benchmark rate in 2018.

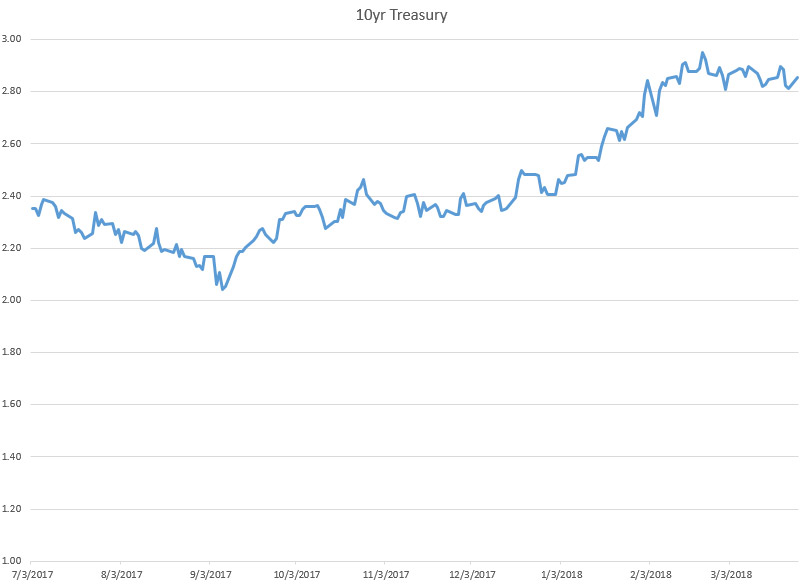

After the Fed meeting, the 10-year Treasury yield actually went down. The reason for this is that the market expected a more hawkish Fed with Jerome Powell in charge, meaning they were expecting a higher forecast for interest rates moving forward. The market was leaning toward four interest rate increases in 2018 and that doesn’t look like it’s going to happen, which is keeping the 10-year Treasury trading in the range of 2.8 to 3.0%.

One more thing of note on the Fed’s dot plot. Jerome Powell in his first press conference de-emphasized the dot plots, saying the Fed can’t see that far in the future. So without looking at the forecast, what should we look at to determine which direction interest rates move?

In the coming weeks you should keep an eye on the following items:

- First and foremost is inflation data which comes out this week. Will the Fed’s inflation measurement move closer to 2%?

- Tariffs and Trade – will the trade disputes between the US and China escalate further with the possibility of a trade war or the potential selling of US Treasuries by the Chinese?

- And last, Payroll and Earnings – will the unemployment rate keep dropping with earnings rising as the Fed continues to expect?

If you would like a more in-depth analysis, please visit our blog. Thanks for watching and have a great day.

Smart Moves Start Here.

Smart Moves Start Here.