Housing News, Videos

Market Update: July 27, 2018

July 27, 2018

You probably noticed there has been very little interest-rate volatility recently. In fact, the tight range on the 10-year Treasury in June was the smallest it's been in several years. July has put some slight upward pressure on rates and the growing consensus is that the Fed is going to keep raising rates even though the yield curve might invert.

You might be asking yourself, "Why are long-term rates staying low even though the Fed keeps raising rates?" There are several reasons, but let’s take a look at the following graphs.

The first one shows the U.S. 10 years over the past year. Notice the yield has been quite stable but rising ever so slightly. Now, look at the yield on the Canadian 10yr, the UK 10yr, and the Japanese 10yr. One big reason rates are staying relatively low in the U.S. is that rates around the world in many countries are much lower.

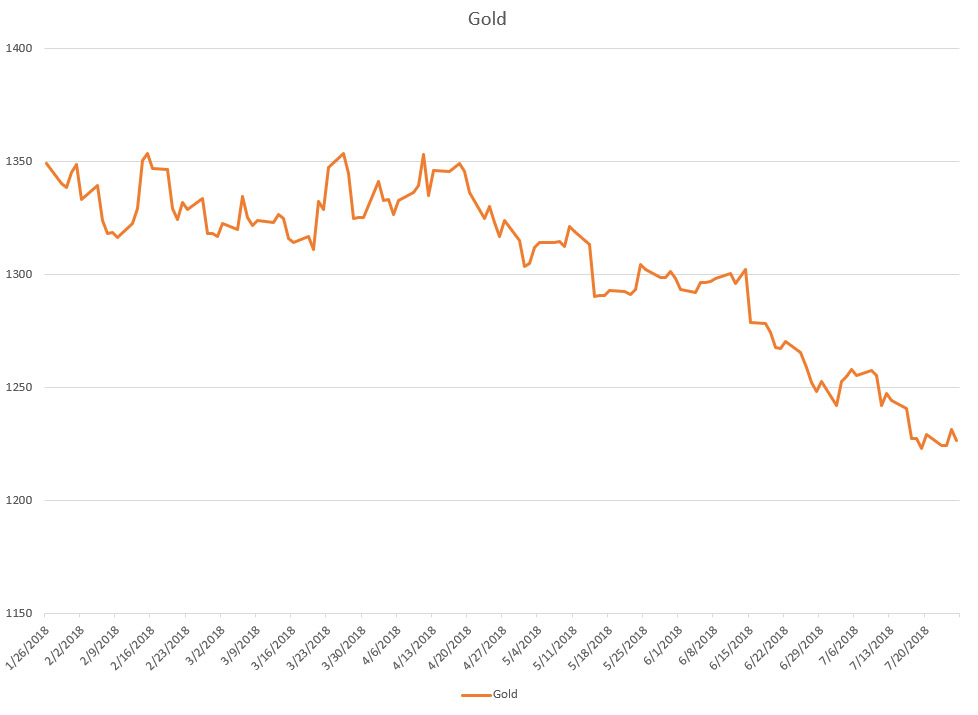

The next chart on your screen shows the price of gold over the past 6 months. As you can see, the price has come down materially. Gold is dropping for two reasons. The first is a stronger economy, which raises the value of the dollar. The second is the lack of inflation or inflationary pressure. Normally during periods of high inflation, the price of gold and other commodities will rise rapidly.

In summary, the gold market tells us that the economy is strong and there is little inflation which is exactly what the interest rate market says. The Fed is raising short-term rates. The prospects for inflation are low and that's keeping longer-term rates low.

Will this trend continue, or will eventually the long end of the curve finally rise, sending mortgage rates higher?

In the coming weeks you should keep an eye on the following items:

- Watch the 10-year Treasury and whether it can stay below 3%. If it climbs above 3.10% then it could be part of the push toward higher rates

- Also, next week’s Fed meeting. The market doesn’t expect them to raise rates but the language on whether they will raise once more or twice more this year is very important.

- And last, let’s not forget about inflation data. Will it give the Fed the excuse it’s looking for to raise rates?

Smart Moves Start Here.

Smart Moves Start Here.