Housing News, Videos

Maintaining Liquidity When Everything Shuts Down

March 26, 2020

No doubt by now you've heard of the major disruptions in the financial markets in the past two weeks with the FOMC lowering interest rates to near zero, stock prices falling by 25%, and long-term Treasury rates moving below 1%.

With the Fed Funds overnight rate near zero percent, there has been a lot of confusion around the level of mortgage rates. So what's happening with mortgage rates?

The last couple of weeks have seen an unprecedented amount of volatility with respect to mortgage rates. One-day mortgage rates are in the low 3's and a few days later in the upper 4's, and now here we are back in the mid-3's. If you didn't know, the key driver of mortgage rates is mortgage-backed securities. unfortunately, the huge stock market selloff and concerns over a deep recession have spilled over into all financial markets, including mortgage-backed securities.

In a normal market, mortgage rates move in tandem with Treasury rates but due to there being a lot more sellers of mortgage-backed securities vs buyers, mortgage rates were actually going up even though treasury rates were going down.

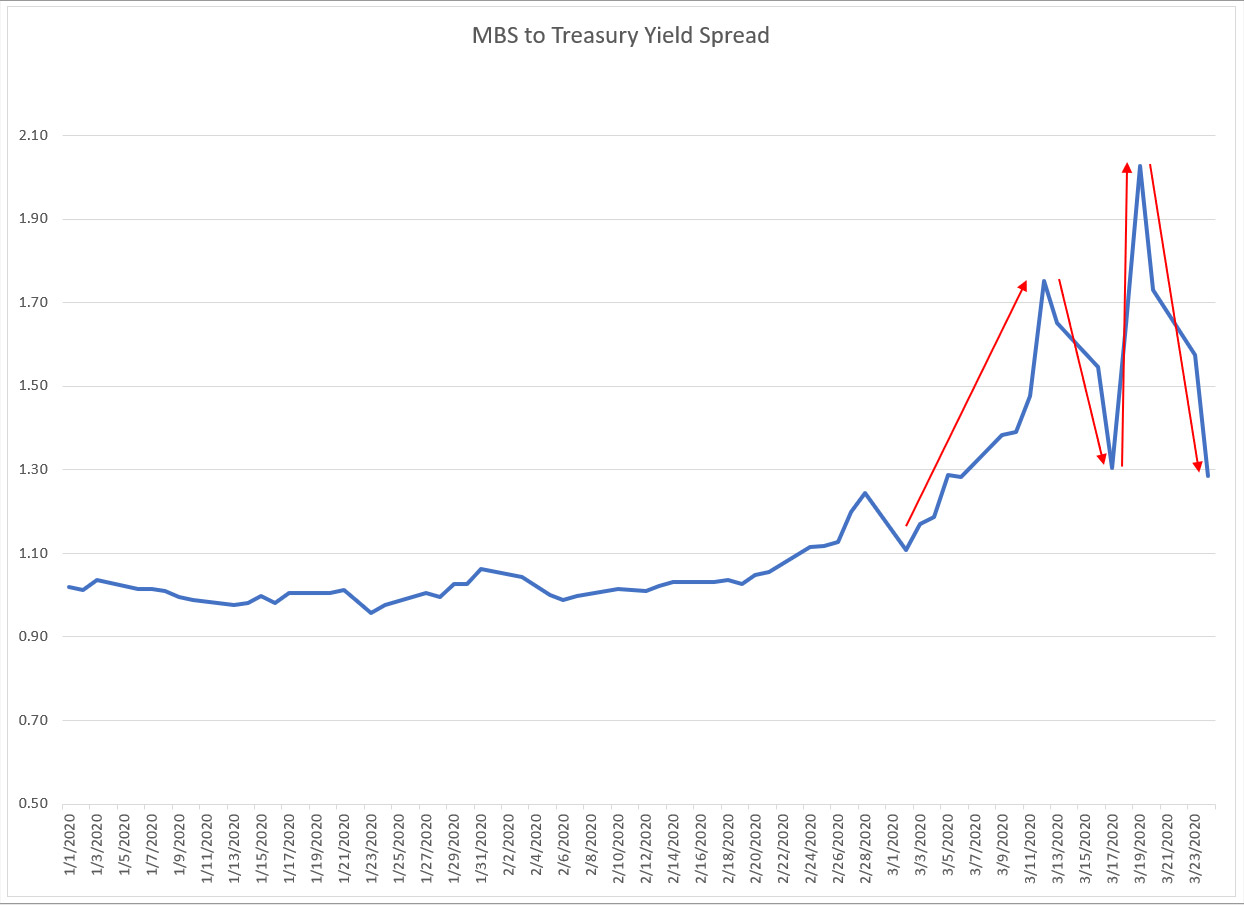

This month we have seen huge swings in the spread between mortgages and Treasuries. The chart below shows the spread between mortgage-backed securities and treasury yields for 2020. Note how much the spreads have increased and then reverse the other direction multiple times. These are unprecedented swings over such a short period of time and what's causing a lot of confusion around the current level of mortgage rates.

Thankfully the Fed stepped up this week to purchase up to $50 billion a day in mortgage-backed securities to help stabilize the market and has made a pledge to use any and all means necessary to keep the market functioning regularly. That doesn't necessarily mean mortgage rates will continue to drop nor does it solve all of the issues facing mortgage-backed securities today, but it does provide a backstop of support.

In the coming weeks, you should expect continued volatility in the market as the challenges faced by the whole world and financial markets due to the coronavirus continue to unfold.

Smart Moves Start Here.

Smart Moves Start Here.