Housing News, Videos

How Would a Slowing Economy Affect Interest Rates?

July 3, 2019

Today we are going to talk about what’s happening with interest rates.

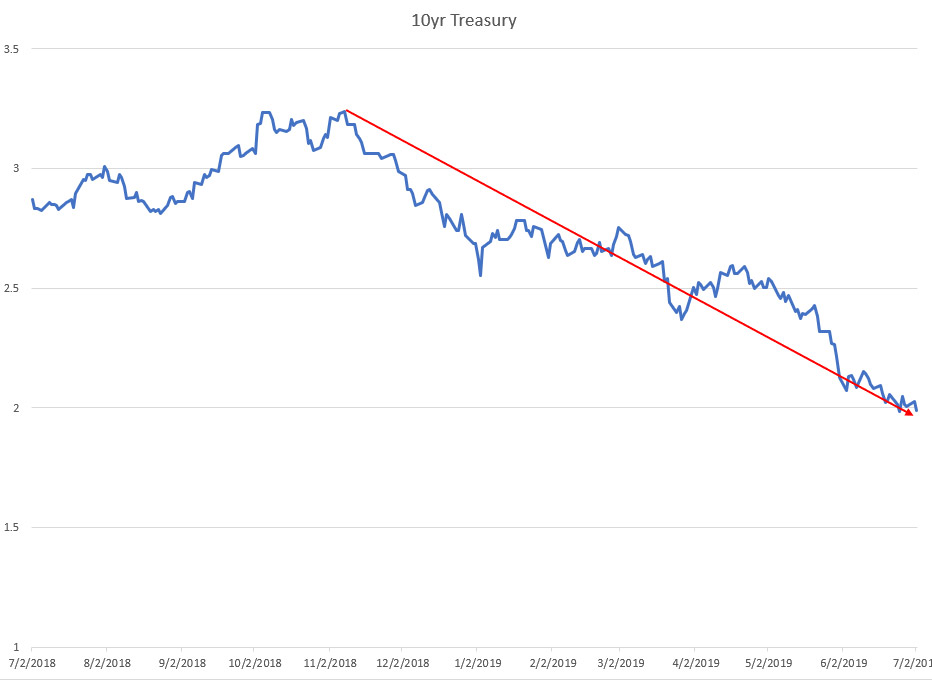

Over the past several months we’ve seen interest rates continue to drop. In fact the 10-year treasury is now below 2%, which is the lowest it’s been since November of 2016. There is no shortage of fear and concerns over a slowing economy. Even though inflation is running north of 1.5% consistently and the unemployment rate is at a 50yr low of 3.6%, there have been signs of a slowing economy such as:

- Gradual leveling of real estate prices

- Declining new home sales

- Declining durable goods orders

- A slowdown in job growth

- Major concerns over the lack of progress on the trade disputes with China

If the trade and tariff dispute with China isn’t resolved soon then fear over an upcoming recession could continue to weigh heavily on the market and rates could fall further. That doesn’t necessarily mean the end of the trade dispute could cause rates to rise quickly. There are still a lot of macroeconomic and global headwinds that will stabilize rates.

In looking at bond yields around the globe, a US 10-year at 1.98% is still relatively high when you compare it to Canada at 1.47%, the UK at 0.73% as well as France, Germany, Netherlands, Switzerland, and Japan all at negative yields.

The global trend is continual global economic struggles with sustained growth and the impact it’s having on interest rates.

In the coming weeks, you should keep an eye on the following items:

- By far the most important is whether or not the trade war with China continues and whether that will push rates down further.

- And let’s not forget about the Federal Reserve. The market is expecting them to lower rates at least twice this year. This could become a very difficult balancing act given that the Fed doesn’t want to lower rates but may need to succumb to public pressure.