Housing News

Here's How Much Money Homebuyers May Save With Every Mortgage Rate Drop

September 19, 2024

Many aspiring homebuyers have been biding their time. They've been waiting for mortgage rates to fall so that purchasing a home may become more affordable. Their patience may soon pay off.

The U.S. Federal Reserve cut its interest rates this week. Mortgage rates typically track with the Federal Funds Rate, meaning if the Fed cuts its rates, it could put downward pressure on mortgage rates.

That could lead to a drop in the interest rate that homebuyers care about most.

Even the smallest changes in mortgage rates can result in big savings. This may help more buyers qualify for mortgages or be eligible for larger loans. That's why more buyers are expected to ramp up their home searches as rates come down.

"It improves their purchasing power," said Ryan Schoen, principal market analyst at New American Funding. "With prices rising faster than incomes, every dollar matters for qualifying for a loan to achieve homeownership."

Homeowners may be able to refinance their existing loans into new ones with lower rates, saving them money each month.

"Homeowners can do the mortgage math and see if they can save substantially," said Schoen. "Any way they can reduce their bills…can mean the difference between having discretionary income to enjoy life versus feeling stressed."

How much can rate drops save homebuyers?

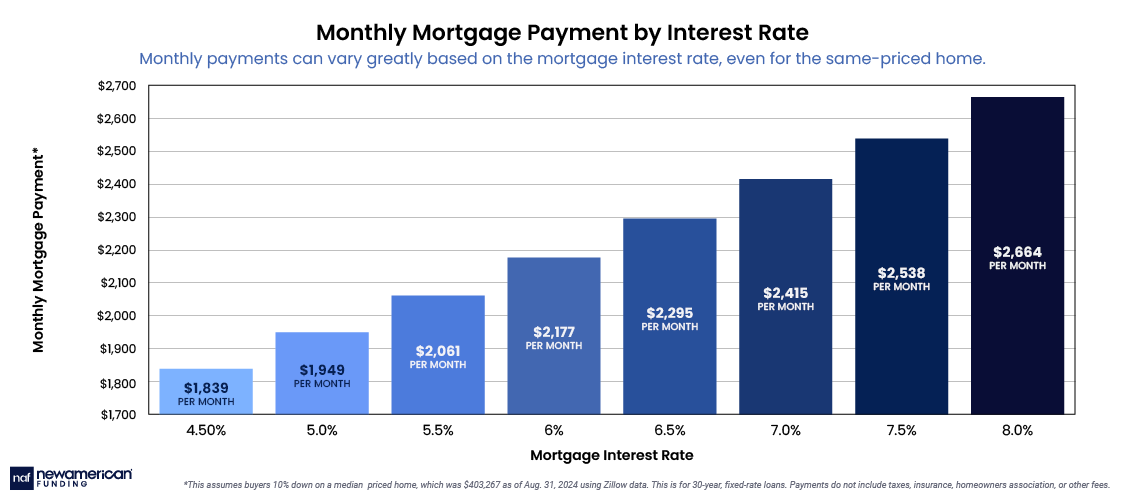

Mortgage rates have already come down from last fall, giving homebuyers contending with high prices a bit of a break.

In late October 2023, rates averaged 7.79% for 30-year, fixed-rate loans, according to Freddie Mac. That was the highest they had been since late 2000.

Since then, rates have come down more than a percentage point and a half to an average of 6.2% in the week ending Sept. 12, according to Freddie Mac,

That could save someone buying a typical home about $388 a month thanks to the lower rates. Over time, that adds up to an extra $4,648 a year and $139,428 over the life of a 30-year, fixed-rate loan.

(This assumes they purchased a median-priced home of $403,267 with 10% down. It does not include property taxes, insurance, or homeowner association fees. The median price data is from Zillow as of Aug. 31.)

"For a family, that could be their grocery bill for the week or two," said Schoen.

Put another way, someone buying the same home a little less than a year ago could wind up spending nearly $140,000 more in interest over the decades. This would be for homeowners who kept their original loan and didn't refinance into a new loan with a lower rate.

That's quite a bit of money they're saving at a time when prices for just about everything remain high, from groceries to Taylor Swift tickets. Some buyers may even be able to put that extra cash toward seeking a larger loan for a more expensive home.

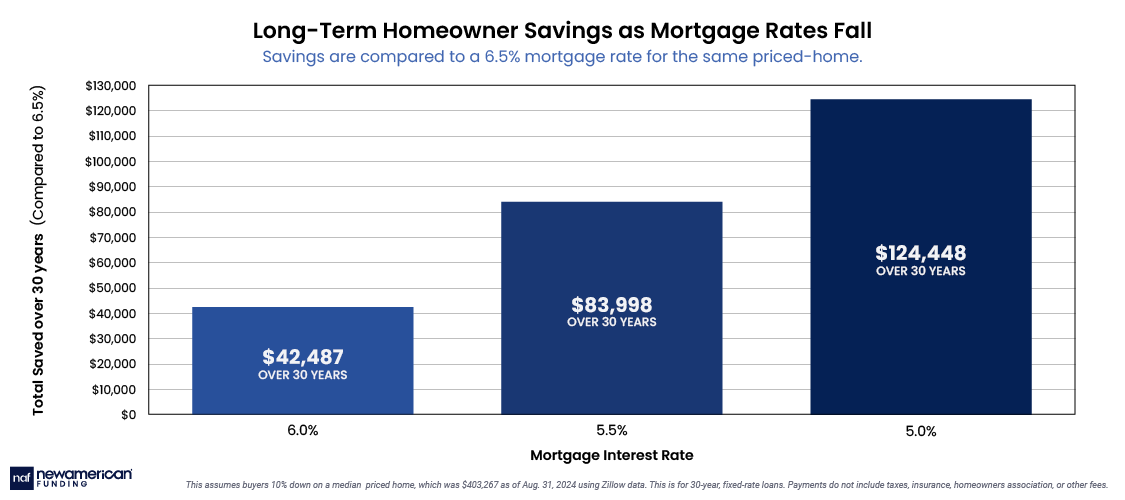

Rates falling even further would equate to more savings. If rates declined from today's average of 6.2% to 5.5%, buyers purchasing that same median-priced home could save an estimated $162 a month, $1,946 a year, and $58,378 throughout a 30-year loan.

However, buyers who wait for rates to continue coming down may have to contend with higher home prices. If lower rates entice more buyers into the market, bidding wars could become more heated, and home prices could rise.

"What seems like an insignificant move in mortgage rates has a major dollar impact," said Schoen. "It can add up to meaningful savings if you take action."

Homebuyers may save the most in expensive areas

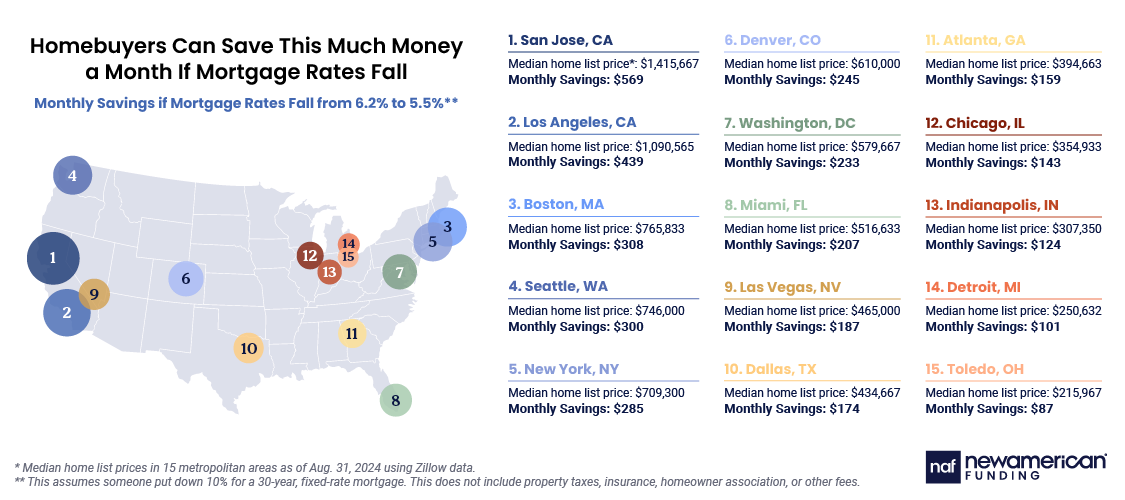

Homebuyers in the most expensive parts of the country are poised to save the most.

That's because homes cost more in these places, so buyers often take out bigger loans. That means they are paying more in interest on larger amounts of money.

Take Silicon Valley's San Jose, Calif. metropolitan area, where the median home list price was nearly $1.416 million as of Aug. 31, according to Zillow.

A buyer who purchased a home at that price with a mortgage might be able to save $506 a month if mortgage rates fell from 6.2% to 5.5%. This assumes buyers put down 20% as larger down payments are more common for larger loans.

That adds up to about $6,072 a year and more than $182,000 over a 30-year, fixed-rate loan.

Homeowners in these areas who took out loans at higher rates may also be able to refinance into loans with lower rates, potentially saving them big money.

However, buyers in cheaper areas wouldn't enjoy such sizeable savings.

Those purchasing a typical home in the Toledo, Ohio metro would save just $87 a month. That's because the median-priced home in the metro was just $215,967 as of Aug. 31, according to Zillow.

The calculation is based on buyers putting down 10% and rates dropping from 6.2% to 5.5%.

Smart Moves Start Here.

Smart Moves Start Here.