Homebuyers

VA Home Loan: Benefits, Eligibility and Application

November 12, 2013

The U.S. Department of Veterans Affairs offers several loan programs to help current Service Members, Veterans, and eligible surviving spouses. It's their mission to provide a home loan benefit and other similar programs to our nation's heroes to help serve their housing needs. Continue reading to find out more about the benefits, eligibility, and application process of a VA Home Loan.

What Are the Benefits?

The VA Home Loan is designed to make the dream of homeownership a reality for millions of veterans and their families by providing housing and assistance opportunities.

This special home loan has many advantages:

- No down payment required

- Negotiable interest rate

- Adjustable & Fixed Rate mortgages

- No monthly mortgage insurance premiums

- No penalty for pre-paying loan

- VA assistance to Veteran borrowers in default due to temporary financial difficulty

- VA funding fee can be financed

- Reduced funding fees with a 5% or more down payment

- Exemption from funding fees for veterans receiving VA compensation

Who Is Eligible?

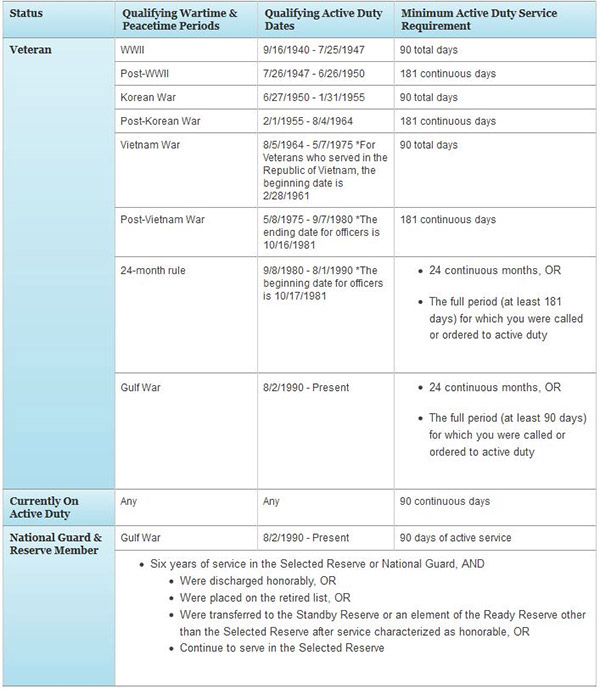

To be eligible for a VA-guaranteed home loan it requires borrowers to have suitable credit, sufficient income, and a valid Certificate of Eligibility (COE). Here is an overview of the Minimum Active Duty Service Requirements to be Eligible for a VA Home Loan:

* If you do not meet the minimum service requirements, you may still be eligible if you were discharged due to (1) hardship, (2) the convenience of the government, (3) reduction-in-force, (4) certain medical conditions, or (5) a service-connected disability.

What Is the Application Process?

- Apply for a Certificate of Eligibility (COE). This certificate verifies the eligibility to qualify for a VA-backed loan.

- Contact a real estate agent professional to assist with finding the home of your dreams.

- Apply for the VA Loan with a lender. The lender will guide the borrower through this process.

- The lender will order an appraisal from a VA-assigned appraiser and begin processing the credit and income information.

- The lender is authorized by the VA to approve and close your loan without waiting for the VA's review of the credit application.

Smart Moves Start Here.

Smart Moves Start Here.