Homebuyers

Good Debt vs Bad Debt - Infographic

June 6, 2018

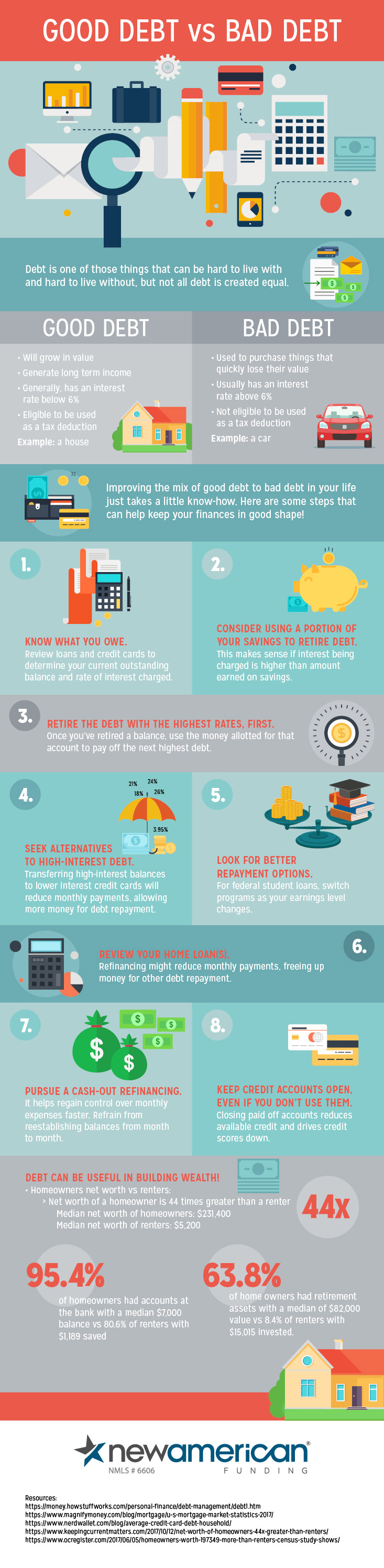

It might sound strange, but not all debt is "bad." Certain types of debt can provide opportunities to improve your financial future. Before you make any decisions, you need to understand the difference between "good" and "bad" debt, and how you can manage it. Check out this infographic and find out everything you need to know when it comes to all types of debt.

Debt is one of those things that can be hard to live with and hard to live without, but not all debt is created equal.

Good Debt

- Will grow in value

- Generate long-term income

- Generally, has an interest rate below 6%

- Eligible to be used as a tax deduction

Example: a house

Bad Debt

- Used to purchase things that quickly lose their value

- Usually has an interest rate above 6%

- Not eligible to be used as a tax deduction

Example: a car

Improving the mix of good debt to bad debt in your life just takes a little know-how. Here are some steps that can help keep your finances in good shape!

1. Know what you owe

Review loans and credit cards to determine your current outstanding balance and rate of interest charged.

2. Consider using a portion of your savings to retire debt

This makes sense if the interest being charged is higher than the amount earned on savings.

3. Retire the debt with the highest rates, first

As you retire a balance, apply funds that paid that account to the next highest debt.

4. Seek alternatives to high-interest debt

Transferring high-interest balances to lower-interest credit cards will reduce monthly payments, allowing more money for debt repayment.

5. Look for better repayment options

For federal student loans, switch programs as your earnings level changes.

6. Review your home loan(s)

Refinancing might reduce monthly payments, freeing up money for other debt repayment.

7. Pursue a cash-out refinancing

It helps regain control over monthly expenses faster. Refrain from reestablishing balances from month to month.

8. Keep credit accounts open, even if you don't use them

Closing paid-off accounts reduces available credit and drives credit scores

Debt can be useful in building wealth!

Homeowners net worth vs. renters:

- The net worth of a homeowner is 44 times greater than a renter

- Median net worth of homeowners: $231,400

- Median net worth of renters: $5,200

- 94.4% of homeowners had accounts at the bank with a median $7,000 balance vs 80.6% of renters with $1,189 saved

- 63.8%of homeowners had retirement assets with a median of $82,000 value vs 8.4% of renters with $15,015 invested.

Smart Moves Start Here.

Smart Moves Start Here.