Homebuyers

Co-Buying and Community: How Younger Generations View Homeownership

April 29, 2024

When it comes to homeownership, we often have a specific idea of what that looks like. Pictures of a happy couple with a dog, smiling kids, and a white picket fence come to mind. But that "traditional" view of the American Dream of homeownership via the nuclear family was popularized in the 1950s.

Throughout history and across various cultures home sharing has taken on many different forms. Multigenerational living has often been the norm, with parents, grandparents, and children all living under the same roof well into the child's adulthood. Many workers have shared living arrangements and non-familial roommates are common.

Changes in Homebuying

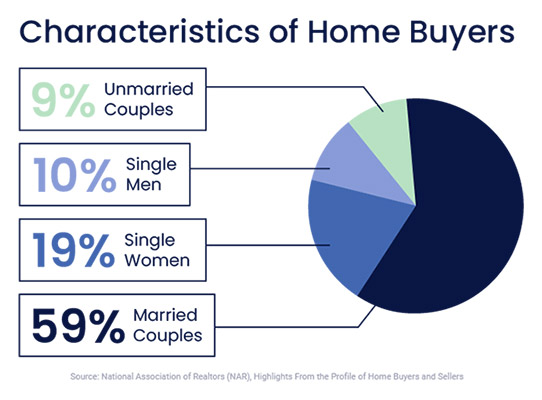

According to the National Association of Realtors (NAR) report of the profile of home buyers in 2023, only 59% of recent buyers were married couples;19% were single women, 10% were single men, and 9% were unmarried couples. 70% of recent buyers had no children under 18 and 14% of buyers bought a multigenerational home.

As the housing market continues to fluctuate and the economy shifts, buying practices will continue to change as well.

A recent Credit Karma survey found that "35% of non-homeowners say that to afford a home, they'd be willing to split the purchase with someone other than their partner."

When looking at Gen Z respondents, that percentage jumped to 59%.

Interview with Niles Lichtenstein

We talked to Nestment CEO Niles Lichtenstein about these shifts in buying practices. Nestment is a co-buying planning and coordination service that specializes in helping homebuyers who are considered less traditional to purchase a home. This includes family and friends who want to buy together, unmarried couples, parents assisting kids, and solo buyers.

Have you seen a wave of young buyers at Nestment?

Yes! 90% of our groups are made up of Millennials and Gen Z. Our youngest buyers are probably around 22 and our oldest are around 40.

What do you think is driving these changes in homebuying?

I think there's a financial reason that's pushing it in a way that has created it to be almost a necessity for a lot of folks. But I think, at the same time, people are recognizing that this could even be a better way to live. There's more of an idea of a sharing economy.

I'll get on my soapbox a little bit, but you know we live in a world where sometimes you feel more and more isolated, right? There's a desire to actually kind of be with people in a different way and have that sense of community. So, this notion of being able to build wealth and build community, I think is something that's become more part of the cultural Zeitgeist.

Also, as minorities become the majority in this country that brings changes too. A lot of different groups here have grown up in different cultures. Whether it's in Caribbean and African cultures, Latin cultures, or certain Chinese cultures, this notion of cooperative economics has existed.

That makes sense. So, sharing a home isn't new, but buying one together like this is.

Yeah, we aren't doing anything new, which is why the concept is so powerful, because it's something that has been around for a while. But the new thing that we're doing is trying to work with great partners. We've created an ecosystem of partners and built a platform that takes the friction out of the process of buying a home differently and doesn't make you feel like you're non-traditional. It makes you feel empowered for these decisions versus made to feel like you're less than because you can't afford to buy the same way others can.

This company seems personal to you.

Oh, it is. My mom was an immigrant and after my dad passed away, we didn't have a ton of savings. But we did have a home. So, I learned how to refinance at an early age, 13, and we were able to take some money out, but we also rented out rooms to UC Berkeley graduate students. So, I grew up with Nigerian math PhDs and Swedish physicists and people like that. It was a lot of fun and it brought a very communal environment.

It's always kind of stuck with me. So, when I bought my first place to make it more affordable for some of my cousins in the Bay Area, it started me down this path co-buying makes sense if you can mitigate some of the risks.

Nestment and New American Funding

As the social and economic landscape continues to change, the way homebuying and homebuyers look will change as well. New American Funding (NAF) is a lender of choice for Nestment because we understand how to work with co-borrowers. The teams at NAF understand that there isn't just one way to buy a home and that the American Dream doesn't look the same for everyone. We're here to help you on whichever path to homeownership you take.

Smart Moves Start Here.

Smart Moves Start Here.