Housing News

Fast-Track to Homeownership: Here's How Much Faster Buyers Can Purchase by Using Down Payment Assistance

July 30, 2024

Erminy and Danny Marquez never thought they would one day be able to move their family into a home of their own. The couple thought they needed a 20% down payment, which was a struggle for the medical biller and car parts salesperson raising two teenagers in a two-bedroom apartment.

However, the couple closed in July on a three-bedroom, two-bathroom house in Lancaster, California. They were able to purchase the $539,900 home in northern Los Angeles County by putting down just $5,000 of their own money.

What was Marquez's secret? Down payment assistance.

"It was life-changing," said Erminy Marquez, 37, of the assistance. "We didn't think purchasing a home of our own could happen."

In today's super-expensive housing market, saving up for a down payment on a home can feel like a monumental task. Many buyers are turning to down payment assistance to help with the upfront costs of getting into a home. This can accelerate their buying timeline significantly, sometimes by years.

"Why not leverage someone else's money to purchase a home?" said Mosi Gatling, senior vice president of strategic growth and expansion at New American Funding. "It can afford you the opportunity to purchase sooner rather than later."

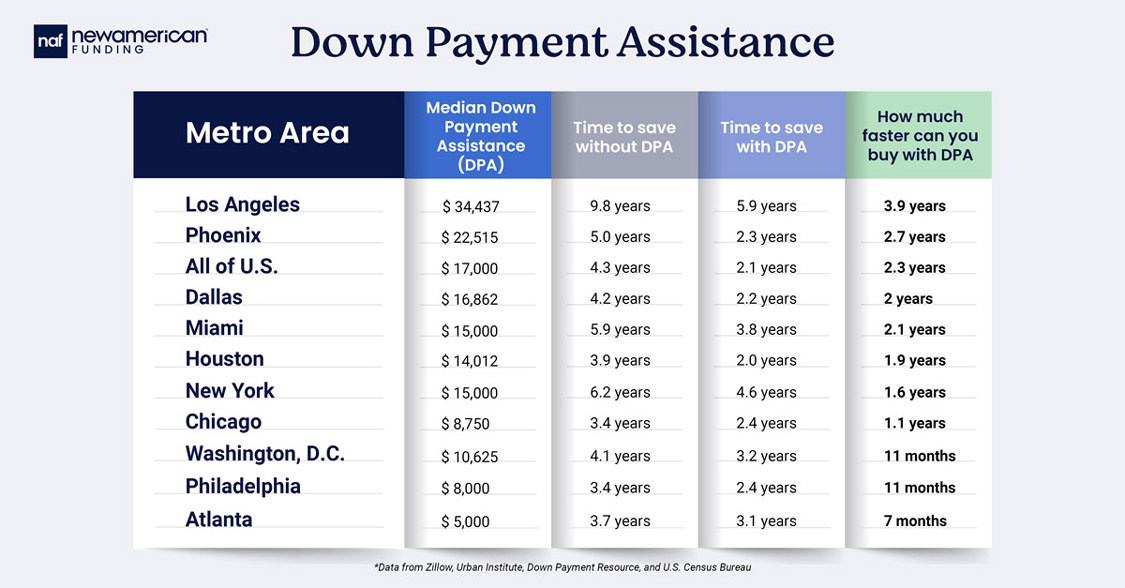

New American Funding looked at the typical amount of down payment assistance that buyers receive in 10 large U.S. metros and how much time buyers can shave off saving up for a down payment by using assistance.

Buyers who receive down payment assistance get an average of $17,000 to help with their home purchase. If they used that money to buy a median-priced home of $405,900, they could save up for an 8% down payment 2.3 years faster than if they didn't use that cash, according to a New American Funding analysis.

This money often comes in the form of a grant or a loan that homebuyers can use to cover their down payments and sometimes even closing costs. (New American Funding's Pathway to Homeownership program can provide eligible borrowers who qualify for the program up to $6,000* in financial assistance.)

There are more than 2,400 down payment assistance programs available throughout the country, according to Down Payment Resource.

"It definitely could be the difference in becoming a homeowner now or not," said Rob Chrane, CEO of Down Payment Resource.

About a third of all mortgage applications that are typically declined could have been approved if buyers used down payment assistance, according to Chrane.

Erminy Marquez learned about down payment assistance through a friend who had used a program.

"It seemed too good to be true. But knowing someone who did it made us start asking questions," she said. "I wish we would have known about this sooner."

The Marquezes worked with New American Funding Loan Officer Brenda Robinson. She helped the couple secure a $35,000 grant plus a roughly $16,000 loan, with a 1% interest rate, from the state to cover their down payment.

"There are funds available to make the homebuying process more affordable," said Robinson, who is based in Inglewood, CA. "Some people wouldn't be able to purchase without them."

The assistance isn't just for those without savings, added Gatling. The additional money can help buyers to stretch their existing savings even further.

"Imagine having three to four months of the mortgage payment in the bank after you've closed on a home," said Gatling. She is also a loan officer based in Las Vegas.

To find out how much quicker down payment assistance can help buyers get into a home, New American Funding calculated how long it would take homebuyers to save up for an 8% down payment on a typical home in 10 large metropolitan areas. Then the analysis looked at how much less time buyers would need to save if they received the median amount of assistance used in these metros.

The analysis used Zillow median home list prices from June. It assumed buyers are saving 10% of the median household income in each metro using U.S. Census median data. Median down payment assistance amounts are as of 2022, according to the Urban Institute's Housing Finance Policy Center's October 2023 Chartbook using Home Mortgage Disclosure Act (HMDA) 2022 data, Federal Housing Administration (FHA), eMBS, and Down Payment Resource data.

An 8% down payment was chosen because this was how much the typical first-time buyer paid, according to the most recent National Association of Realtors data.

So, how much quicker can buyers who use down payment assistance save up for a home?

1. Los Angeles

Median home price: $1,079,000

Years to save for an 8% down payment: 9.8 years

Median down payment assistance: $34,437

How much time down payment assistance can save buyers: 3.9 years

2. Phoenix

Median home price: $515,000

Years to save for an 8% down payment: 5 years

Median down payment assistance: $22,515

How much time down payment assistance can save buyers: 2.7 years

3. Miami

Median home price: $520,000

Years to save for an 8% down payment: 5.9 years

Median down payment assistance: $15,000

How much time down payment assistance can save buyers: 2.1 years

4. Dallas

Median home price: $437,967

Years to save for an 8% down payment: 4.2 years

Median down payment assistance: $16,862

How much time down payment assistance can save buyers: 2 years

5. Houston

Median home price: $365,667

Years to save for an 8% down payment: 3.9 years

Median down payment assistance: $14,012

How much time down payment assistance can save buyers: 1.9 years

6. New York

Median home price: $713,000

Years to save for an 8% down payment: 6.2 years

Median down payment assistance: $15,000

How much time down payment assistance can save buyers: 1.6 years

7. Chicago

Median home price: $356,600

Years to save for an 8% down payment: 3.4 years

Median down payment assistance: $8,750

How much time down payment assistance can save buyers: 1.1 years

8. Philadelphia

Median home price: $356,700

Years to save for an 8% down payment: 3.4 years

Median down payment assistance: $8,000

How much time down payment assistance can save buyers: 11 months

9. Washington, DC

Median home price: $597,417

Years to save for an 8% down payment: 4.1 years

Median down payment assistance: $10,625

How much time down payment assistance can save buyers: 11 months

10. Atlanta

Median home price: $395,667

Years to save for an 8% down payment: 3.7 years

Median down payment assistance: $5,000

How much time down payment assistance can save buyers: 7 months

Smart Moves Start Here.

Smart Moves Start Here.